Zerodha is the leading discount stock broker in India with over 15+ lakh clients. It offers trading services in equity, currency and commodity options. Zerodha customers can buy stocks, mutual funds, IPO and trade in derivatives at BSE, NSE and MCX. You can check the detailed Zerodha Review here.

Zerodha has its own developed trading platform which is Zerodha Kite Application. By using this application, you can easily buy and sell stock through mobile, desktop or web browser after completion of Zerodha Account Opening and Loging in to Zeroda Kite App

Most of the people who opened a Zerodha Demat Account don’t know how to use its trading platforms for buying and selling stocks. So in this article, we provide you with detailed information on how to buy shares in Zerodha kite App. You can also know the step by step process to invest in mutual funds through Zerodha Coin and Investing in IPO through Zerodha Console using provided link

Zerodha also allows you to calculate the exact brokerage or margin charge by using Zerodha Brokerage Calculator and Zerodha Margin Calculator.

If you don’t have a demat account then it is highly recommended to Open Zerodha Demat Account using this direct link to access their trading platforms and offers for free.

Related Post: Is Zerodha Safe – 9 Reasons to Know

How to buy shares in intraday through the Zerodha Kite app?

Table of Contents

To buy and sell shares using Zerodha Trading Platform, you need to know about a few important steps, which are

Analyzing the stocks

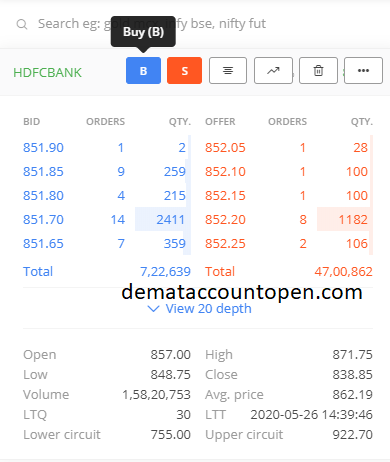

- To analyze a stock, you need to select the stock you wish to buy from your watchlist.

- After selecting the stock, you can check its details like market depth, bid, the number of orders, offers, and quantity along with the “buy” and “sell” option will appear.

- Before you place the “buy” or “sell” order, you can view and examine the charts of that particular stock by clicking on the “charts” icon

Placing the Intraday MIS Buy order in Zerodha Kite App

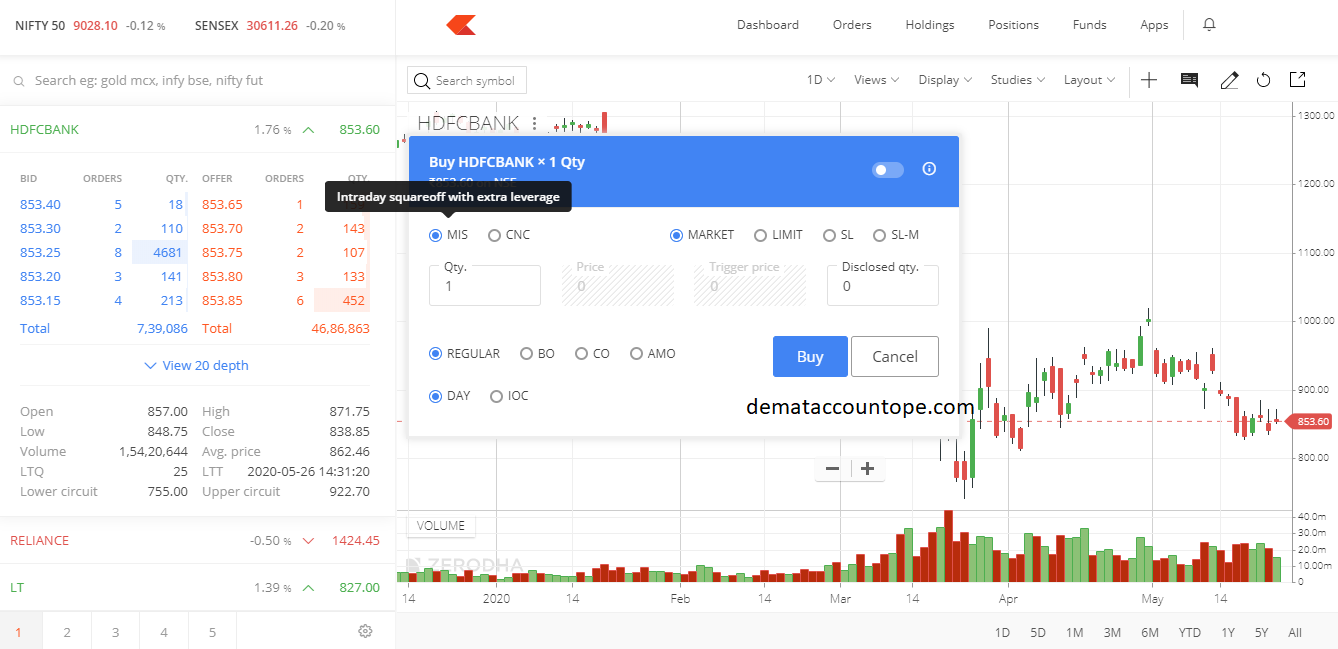

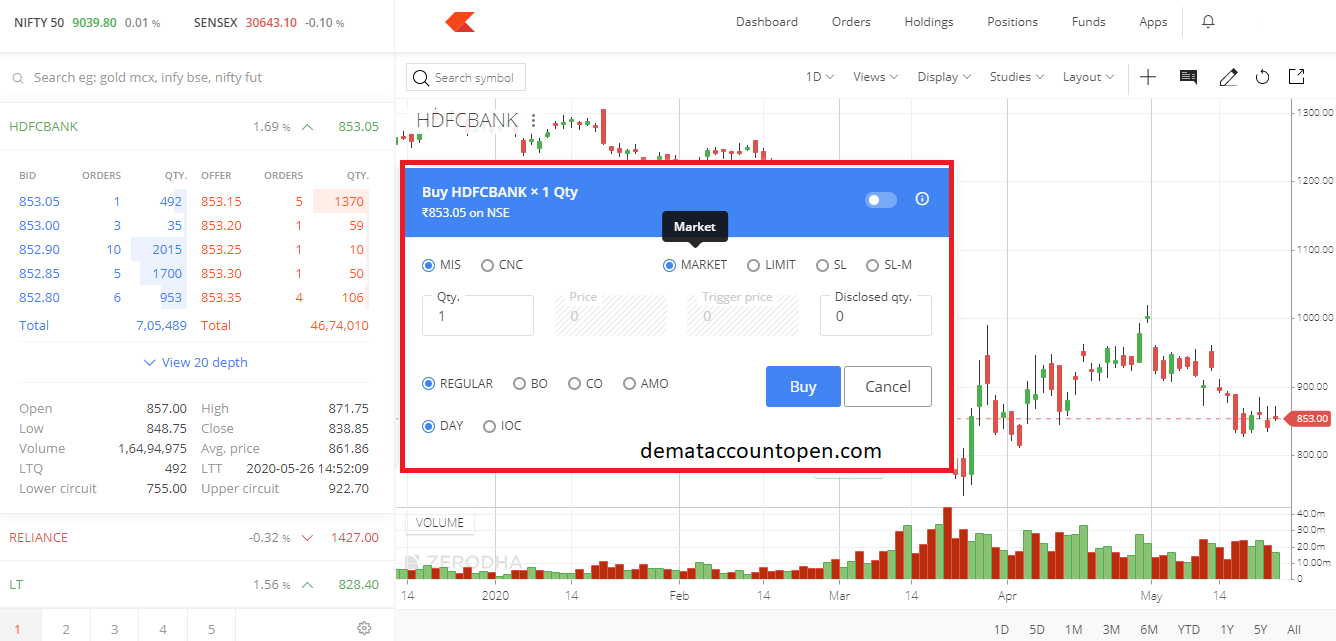

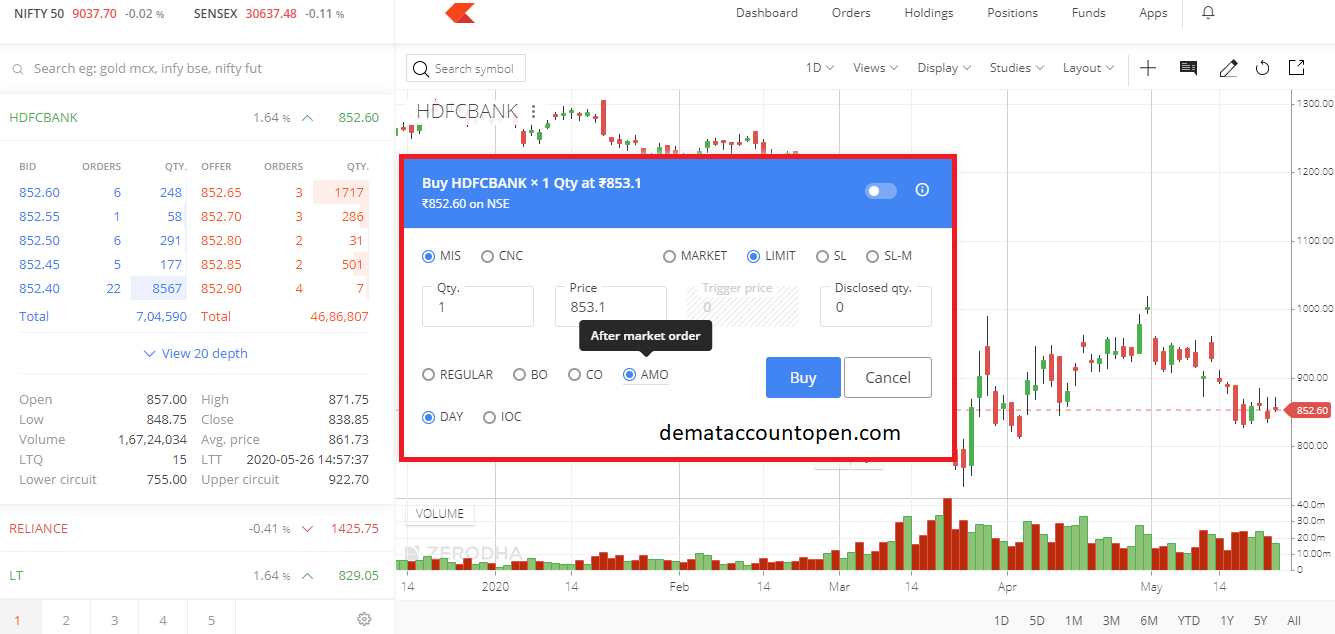

Once you have selected the stock in which you want to trade, you need to click on “buy” which is marked in blue colour and fill the quantity of stock you would like to purchase and select the “MIS” box.

Since we are carrying out an intraday trade, we need to square off the buy position and sell position before the market closes. MIS full form is Market Intraday Square off, which is a part of Zerodha Intraday Trading where you need to complete your trade within one single trade day. In Intraday trading, you need to buy and sell the stocks on the same day.

Select the order type in Kite by Zerodha App

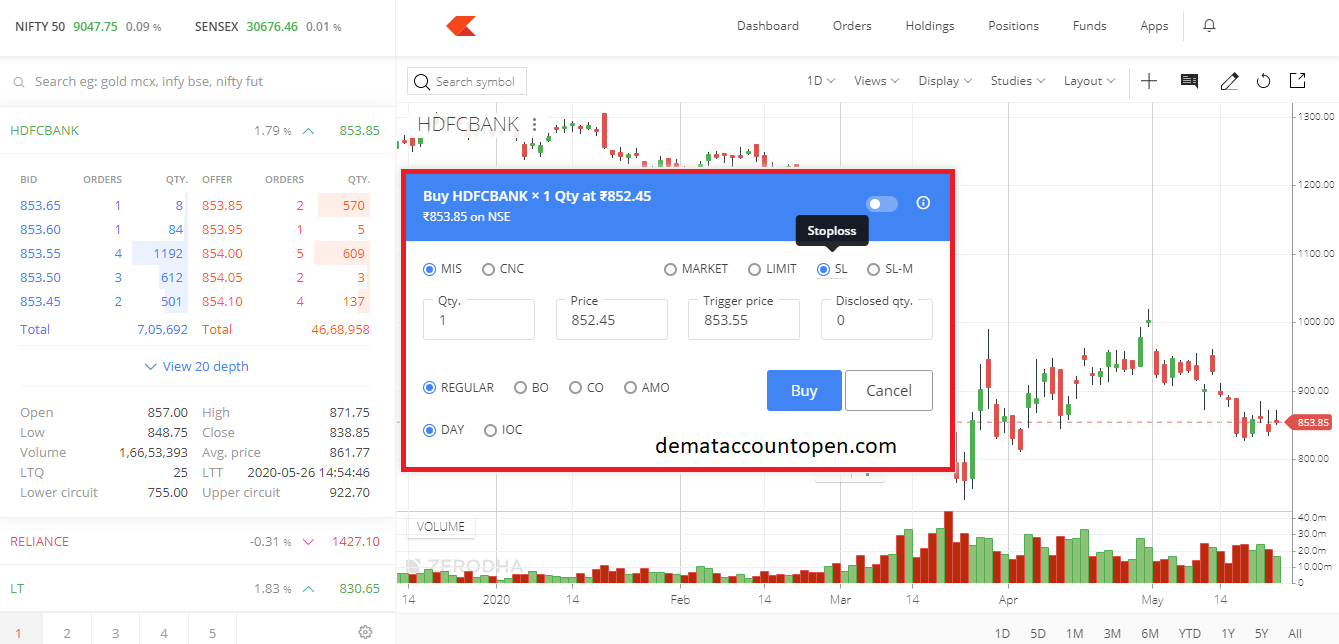

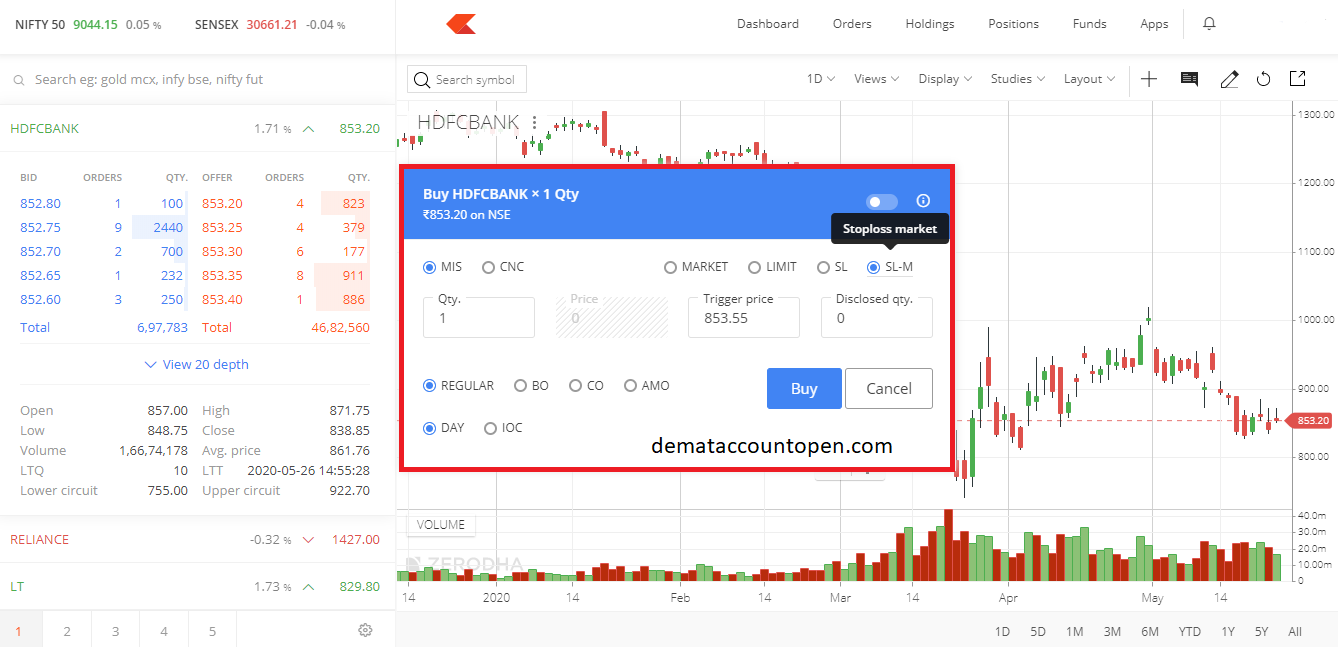

To place the stop-loss order using Zerodha Kite App, you need to

follow the steps below.

- The options provided by Kite by Zerodha App to select the order type are

- Market

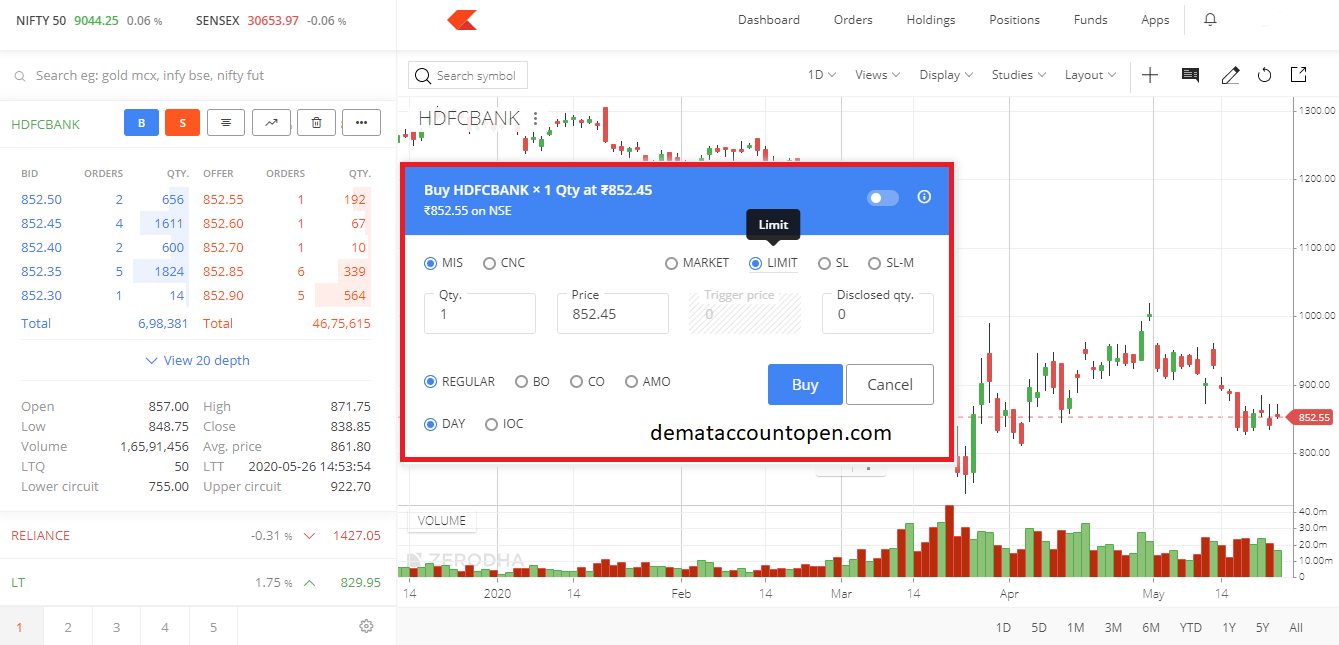

- Zerodha limit order

- SL (stop loss limit order)

- SLM (stop loss market order)

- If you are looking to place a market order, then you need to select the “market” as your order type. In the market order, you will not be able to change the order price because it will be executed on the current market rate.

- If you are looking to place limit as the order type, you have a profit to set an order type as per your desire. In this, the “buy” order will be executed if the limit price is reached before the auto square off time.

- SL stands for Stop Loss buy order. Stop loss buy order means that a limit buy order is places when Stock hits a certain trigger price. SL order is useful when you want to buy share when your stock goes above a certain price. Example is some stock is trading at 100rs and you want to buy that stock only if it goes above 102 rs , you place a SL order with 102 as trigger price and any price below 102 as limit price. The limit orders are places when the stock hits the stop-loss trigger price. Please note there is no guarantee that your order will get executed in this case. In cases when stock spikes up very fast and does not come back, your limit order will remain open.

- SL-M stands for Stop Loss buy order at Market price. It is same as previous SL order with one small difference – when stop loss trigger price is hit , then market order will be placed instead of limit order .SL -M order is useful when you want to buy share when your stock goes above a certain price. Example is some stock is trading at 100rs and you want to buy that stock only if it goes above 102 rs , you place a SL-M order with 102 as trigger price (note there is no limit field here as market order) . The market orders are placed when the stock hits the stop-loss trigger price. Please note that since its market order, its likely it will get executed slight above the trigger price depending on order quantity and seller availability. In cases when stock spikes up very fast , executed price may be some points above the trigger price

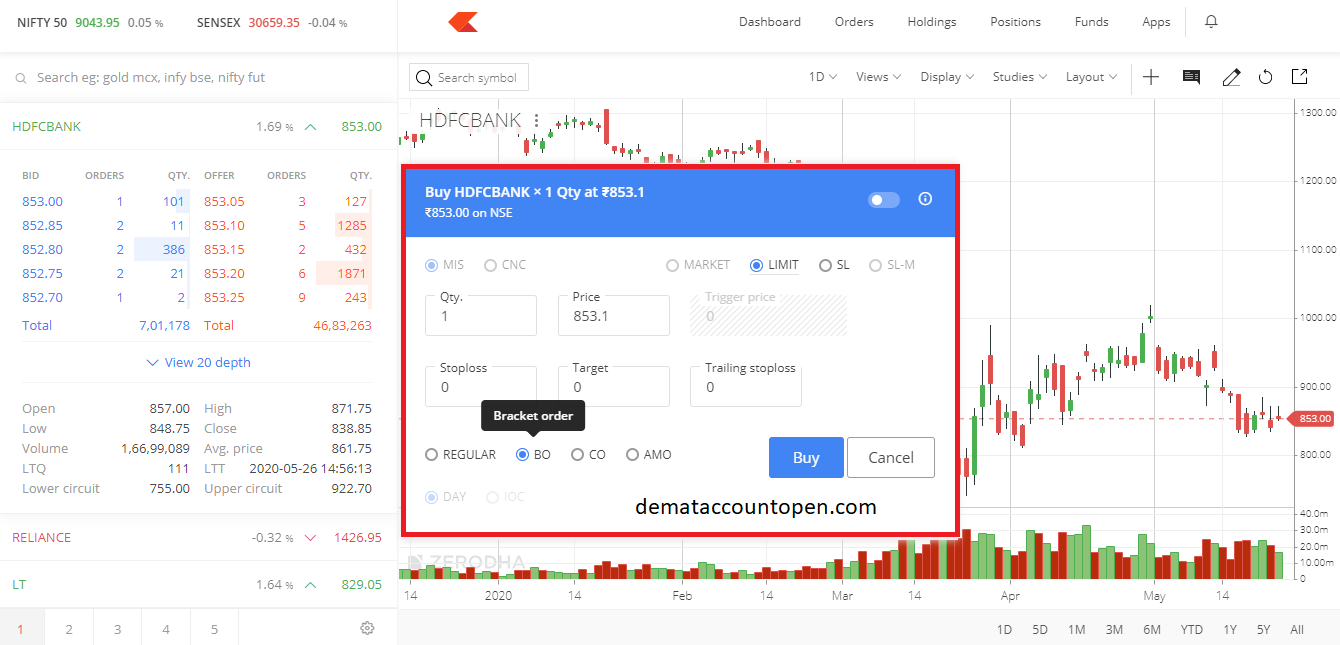

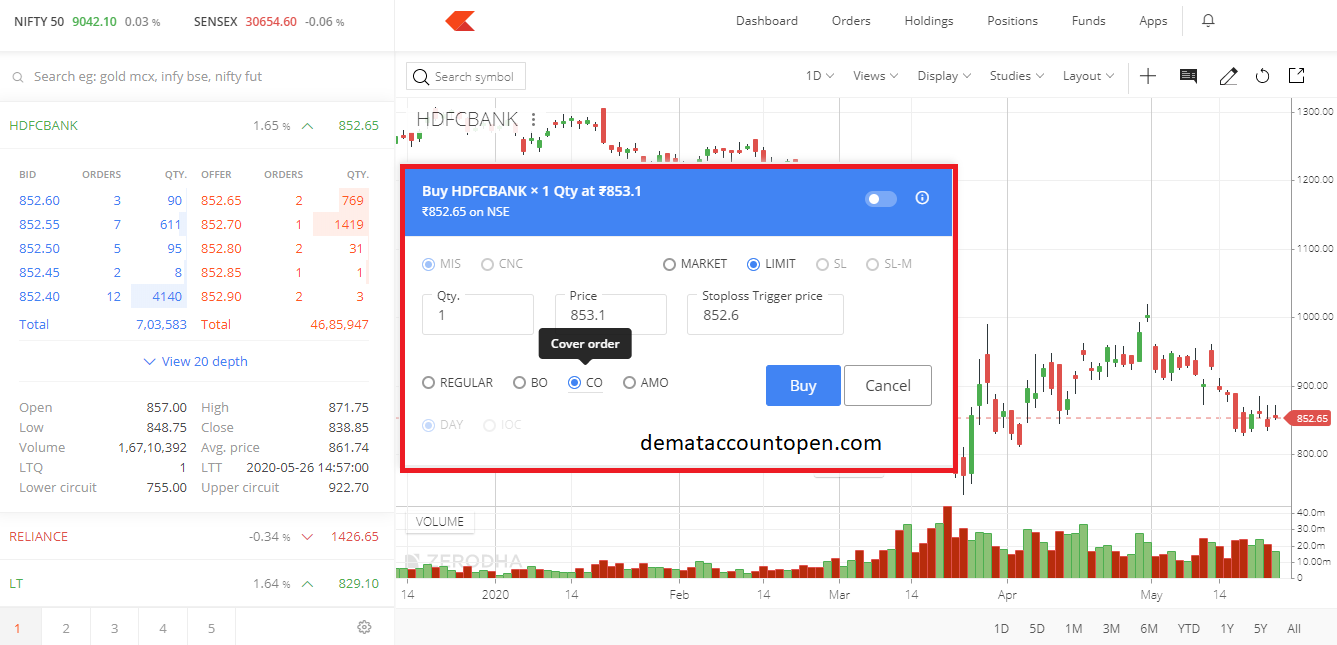

Placing advanced orders

You can place advanced orders under this segment, you can place advanced orders by place orders with

- BO which is Bracket Order,

- CO which is Cover Order, and

- AMO which is Aftermarket Order.

Buying & Selling Stocks using Zerodha Bracket Order

You can trade in range by selecting “Bracket Order” Zerodha. You need to set a “target price”, the position will square off only when the stock hits the target price.

You can enter a “stop-loss price” which will help you to reduce your losses. The whole set up of bracket order works as a bracket for your order that assures profits or losses as per the market movements.

Buying & Selling Stocks using Zerodha Cover Order

If you looking to buy the shares in Zerodha kite using Cover Order it is advised to put “stop-loss trigger” as the order provide a higher leverage/margin.

The difference between the current price and the stop-loss placed should not be more than 2% of the risk-reward ratio. You can cover your losses by placing an order using Cover Order.

Buying & Selling Stocks using After Market Order

After Market Order is a particular order for those investors who are not available to trade during the Stock Market Timings. You can place After Market Orders in Zerodha between 3:45 pm to 9:00 am.

To place an order, you can select the stock you wish to purchase, fill in the quantity and price you want to purchase and select “AMO” from the “variety” section.

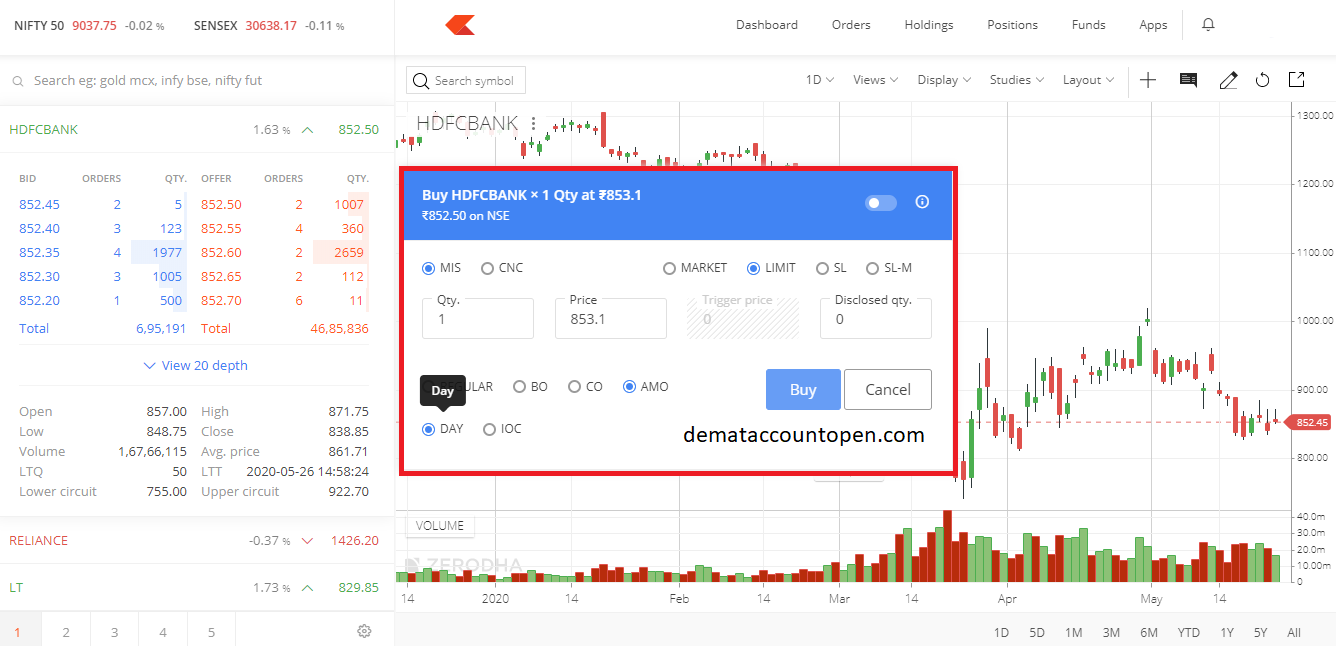

The validity of the order

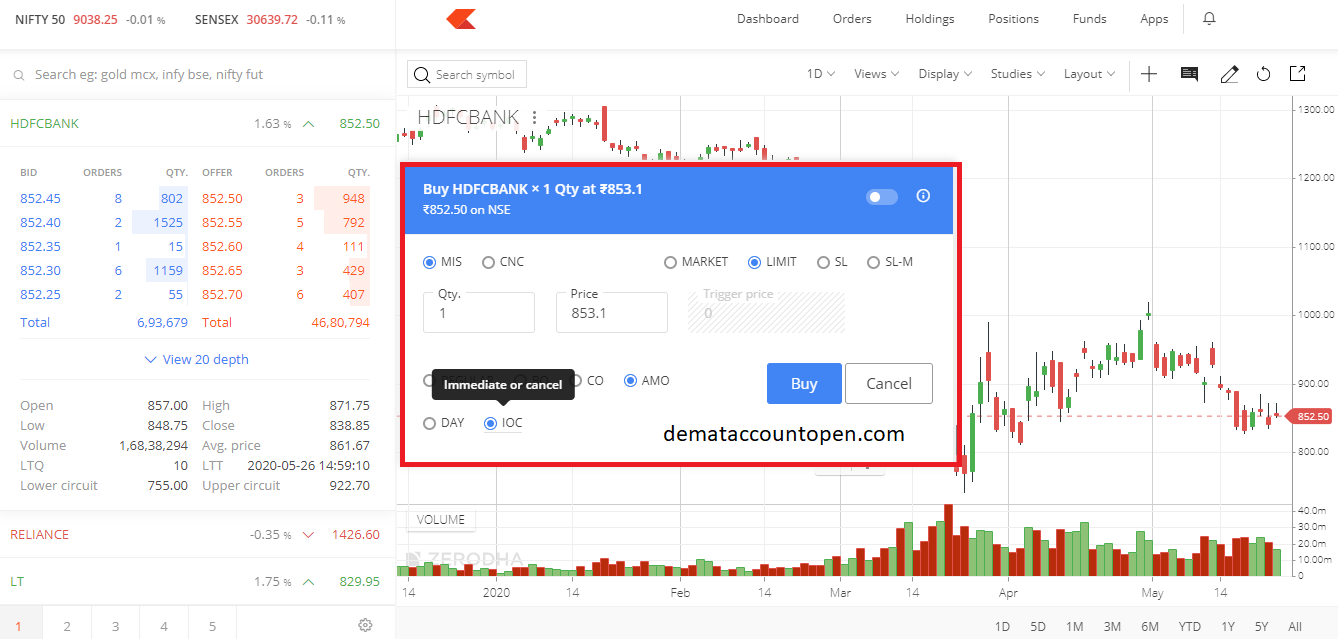

- The validity of the order contains two options, which are “DAY” and “IOC – Immediate or Canceled”.

- If you select the day validity, your order will remain valid for that entire trading day.

- You can select an Immediate or Canceled ( IOC) validity if your order quantity is huge.

- Let us take an example if you have placed 120 orders and get a seller for only 90 of them. As IOC in zerodha is applied the 90 orders will be executed while the remaining 30 will be cancelled.

You can place orders by using both zerodha kite web or zerodha kite mobile application. As the desktop has a bigger display, you can easily analyze the charting. You can also avail the margin from the stockbroker to execute a trade.

How to buy Delivery shares in Zerodha kite app?

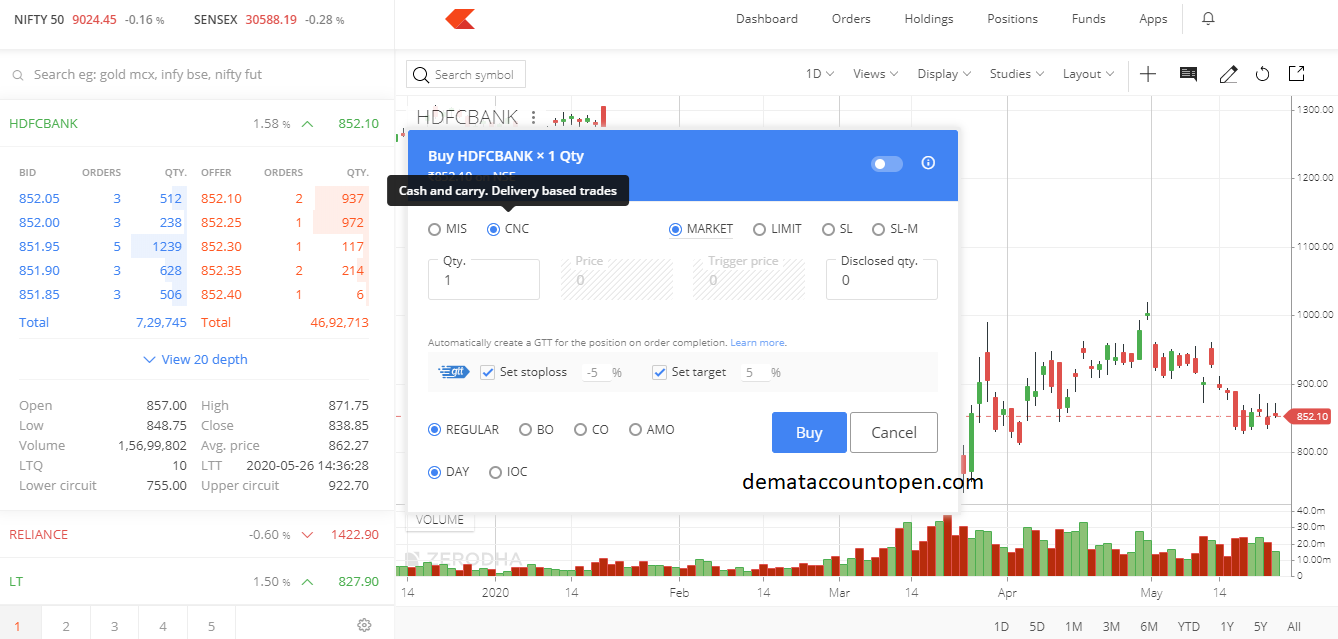

Cash And Carry (CNC) are used in delivery trades where an investor does not wish to sell the share on the same day.

To buy the shares in delivery, you need to enter the quantity of stock you wish to buy and click on “CNC in zerodha” under the “product” section. As CNC stocks are designed for long-term investments, it is better to select “market” as the order type because nothing can be predicted exactly for a longer span of time.

FAQs

How to buy stocks in Zerodha?

Steps to buy/sell Equity or Nifty Options in Zerodha

1. You need to open Zerodha Demat Account

2. Log in to the Zerodha Kite website or mobile app.

3. Add funds to your Zerodha account.

4. Add desired Options to your market watch.

5. Place a Buy order for the Option.

6. Understanding the Options contract.

7. Check for the execution of the order.

Does Zerodha charges for buying shares?

For equity intraday trades you will be charged 0.03% of turnover or Rs. 20 whichever is lower per executed order. For more information refer the charge list & stamp duty rates.

Best Demat account online

Broker | Rating | Link to Open | |

|---|---|---|---|

Zerodha No.1 Stock Broker in India | ★★★★★ | ||

Upstox | ★★★★ | ||

Angel Broking | ★★★★ | ||

5 Paisa | ★★★★ | ||

StoxKart | ★★★★ |

Leave a Reply