Currently, there are about 10.43 crore active Demat accounts in the country. Noticeably, some investors are more likely to gain a higher profit margin than others, some freshers would do better than the natives, and some low-cap investors would get better return percentages than those who are trusting of the blue-chip stock and ends up investing way more.

Wondering why this happens in sensex investing?

In this article, we’re exploring the can-can of highly profitable investments, the real meaning of being a successful stock market investor and how the mind of a successful investor work.

It takes more than just a gut feeling and some capital to be in stock market.

If you are someone who’s exploring how to earn 5000 per day or an exponential figure of that, this one’s for you.

The two most important factors before setting out to be a successful investor are:

- Splendid purchasing decisions

- Building the right, and malleable propensity

As per the Indian Big Bull, successful investing lies in locating the gaps between one’s current expectations and the calculated probability of gaining profits in the future.

We have listed 5 universally replicable action points to become mighty successful in your journey.

- Get Exposed To The Internet Of Data and Trends

Go through the myriad research reports, case studies, observations, graphs, and case studies available. Understand what really causes the Order Book model to change. As a fresh, you can start by reading about the basic financial jargon and maybe about the various short-term investments in India.

Further, it is best to understand the business at hand, the product shelf life and the generic futuristic permanence of the vertical. For instance, the world did go into a state of ‘economic recession’, but it is more like a shift in the economy’s sensibilities.

When the stock prices of Meta and Google declined in December 2022, the tech giants were assumed to not stand the tests of time. In turn, the stock prices rose back again by +3.19% and +0.22% respectively.

This happened also because the innovation wing of the companies explodes and makes space for products and ideas to secure a better future. Company news and press releases also keep relevance alive, urging an increased pool of buyers.

Keeping a track of the company, industry vertical and innovation trends around them, and in-general buyer trends can be important metrics to help you amp up your stock market game.

2. Watch Out For The Butterly Effect in Finance

Table of Contents

- In which industry did Warren Buffet start investing heavily?

- Which are usually the top industries

By definition, the Butterfly Effect is a concept in chaos theory that describes how small changes in one part of a complex system can have significant and unpredictable effects on the system as a whole. It finds great applications In the financial industry. But of course, seemingly insignificant events or decisions can lead to major financial outcomes, which is why most successful investors think many times and do not exhibit herd syndrome.

Keeping a close eye on The butterfly effect can also be seen in the realm of financial forecasting, where small differences in assumptions or inputs can lead to vastly different outcomes. This highlights the importance of careful analysis and consideration of all factors when making financial decisions. For instance, Meta Platforms Inc. nose dived by $232 billion in just a single day, making it the biggest single-day loss in the history of the stock market. It doesn’t end here. The very next day, Amazon- another tech giant, recorded the highest single-day gain. On January 4th, 2022, Amazon’s market capitalization hiked by $190 billion, which is a 14% hike.

The Butterfly Effect effect underscores the interconnectedness and complexity of financial systems, and the potential for small changes to have big consequences.

3. They have a diversification strategy

One of the important things to keep in mind to secure a stable and profitable investment via Demat Accounts is to have a diverse portfolio. Refrain from putting all your eggs in one basket.

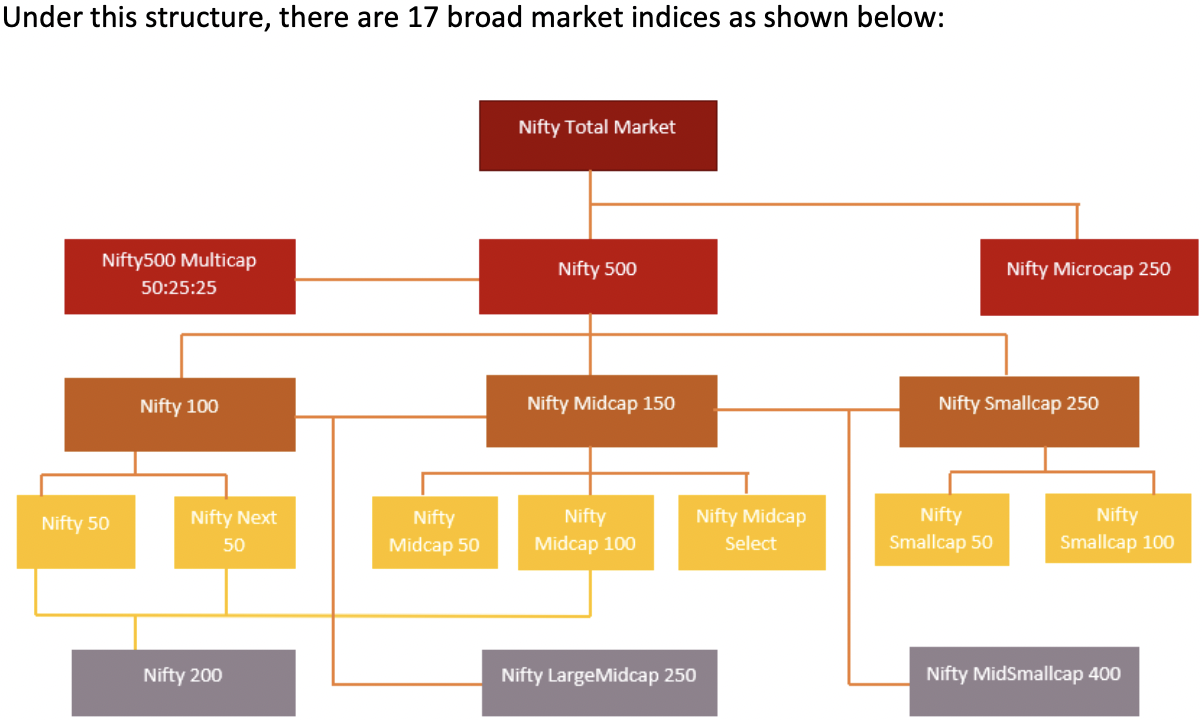

It basically means, having a broad mix of investments. According to experts, building a 60/40 portfolio, with 60% capital to stocks and 40% to fixed-income investments was the most recommended practice. Today, that is argued for having limited applicability for only younger investors, thereby excluding seasoned investors. One can start by investing a small percentage in tech stocks, energy stocks, and medical stocks to name a few. Or they can diversify their portfolio by including some small, some large and the rest under high dividend, growth and value stocks. Understanding their functioning, processes, trends and usability is crucial after all.

As Warren Buffett said “Diversification is a protection against ignorance. It makes very little sense to those who know what they are doing.” So, diversification works very well in risk distribution and reducing the probability of losses.

4. They Think Long-Term And Use Quantitative Strategies

Use Quantitative formulas to find the theoretical value of your stocks and bonds. We highly recommend all natives, freshers, and averagely-seasoned investors to always aim to improve the probability of a high ROI rather than predicting a high ROI.

This means, getting better at calculations, rather than following your gut and redistricting yourself to pre-set success templates. Pre-set success models hardly work and reduce the probability of success.

A high ROI may happen nevertheless, but that profit should brother be trusted, nor replicated. Thinking long-term entails making more informed decisions with your stock quantities. To start with, these are some quantitative formulas to follow:

- The Black Scholes-Merton Model (BSM)

- Does what: Calculates the theoretical values of derivatives. Helps you keep on the market’s liquidity.

- Uses what: Strike price of an option, stock’s current price, the expiration date of that stock, volatility, and the risk-free rate of the stock.

- Triangle Analysis

- It’s a simple way of studying graphs. Well, they show mostly obvious trend curves. Three types of Triangle graphs exist Ascending(when the price breaches the line and indicates a rise in volume), Descending(when the price tends to fall below the line and indicates a dip in volume) and symmetrical.

- Symmetrical triangles represent a continuation of the break patterns. They fall in the direction of the initial move but soon form a triangle. If a symmetrical triangle is formed after a price hike, it’s safe for the experts to expect an upward price break in the near future.

Instead of aiming for absolute profitability, it’s best to aim to demystify the reasons and core factors which are usually directly or indirectly affecting the rise and fall of a company’s worth. Tapping on the root cause is a smarter move, a more challenging one, and usually requires more calculation.

5. Do What You Think Is Right And Save

One of the biggest mistakes that most investors make is to follow the herd. It provides a sense of freedom to blame the faulty trends than holding oneself accountable. What may have worked last week wouldn’t probably work for the same stock this week. Making a wise and informed list of deciding factors coupled with patience and the skill to read the signs will make you an investor who makes your own profitable journey. ‘Templatising’ strategies is the first step to financial losses and can be frustrating in the long run.

Options are bleak when it comes to exploring ways how to make money online without investment. Being a successful investor starts by having the financial wisdom required to sustain that momentum. Wealth generation comes with a habit of respecting and being mindful of the profits made. Saving from the early days early is a powerful force for making progress toward your long-term financial goals. As a general rule, we suggest you put away 15% of your profits and 15% of your income.

Investing can be complex, but it only takes a little push and sharp observational skills to make that 1-0 journey. Financial growth that births the moment you open a Demat account should compel you to study and apply the point where economics, geo-political trends, mathematics, actuarial, and basic logic intersect. Making a calculated risk would probably give you some lows before you define new zeniths with every decision. Staying brisk with the ODA’s insights and glossary can open doors for you that you didn’t expect existed.

Leave a Reply