Angel One is one of the best full-service broking houses in India. Let us have a detailed Angel One Review & get a good understanding of Angel One Demat Account, Angel One Brokerage Charges, Angel Trading Platforms & other important features.

Angel One Pvt Ltd is one of the leading broking houses in India and has been in the business since 1987. It is dedicated to a retail stock trading model. It provides modern and useful trading platforms as well as expert advisory services to its customer base.

Click Here

How To Open Angel One Account – Brokerage, Benefits and Services Review.

The Angel Group is also officially a member of the Bombay Stock Exchange, National Stock Exchange and two commodity exchanges- the NCDEX and MCX. It is also registered as a Depository participant with CDSL.

As a broking house, it has more than 27 years of expertise in share and commodity markets. The Angel Group comprises Mutual Funds, Commodities, Life Insurance, Institutional Equities, and Angel Fincap.

Angel One also has a nation-wide presence in 1000 cities. It has a strong network of 8500+ sub-brokers and more than 1 million clients.

Its main offerings include Equity Trading, Commodities, Portfolio Management Services, Mutual Funds, Life Insurance, IPO, Depository Services and Investment Advisory. It also provides Wealth Management and E-broking facilities.

Angel One Review – Trading and Demat Account

Table of Contents

Angel One offers a new-age technology, user-friendly trading platform, and empowers traders and investors by providing its market expertise.

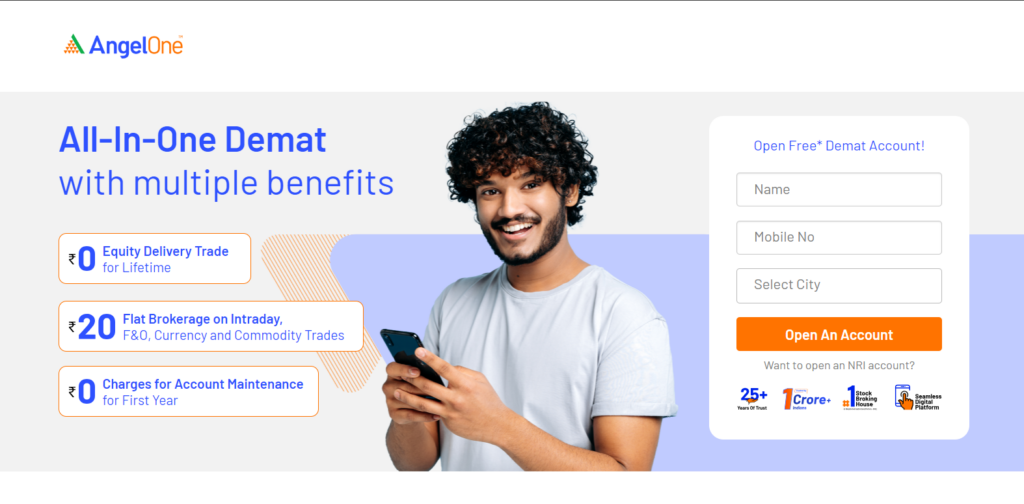

- Angel One provides a fast and hassle-free online Demat Account Opening process. One can open an Angel One Account within 10 minutes.

- Zero cost brokerage in equity delivery segment for a lifetime.

- The flat brokerage of Rs 20 per order across intraday, F&O, currency, and commodity trading

- Free access to advanced technology trading platforms; Angel One Trade, mobile app, and Angel SpeedPro.

- A full suite of broking services including free research and advisory

Angel One Review – Account Opening Process

Angel One Account Opening can be done both online and offline.

Online Process to Open Angel One Account

The process to Open Angel One Account online is easy. If your Aadhaar card is linked with your mobile number, then the Angel One Account opening process can be done online.

Once you complete uploading documents and e-sign process online, your Angel One Account will open within a day. You can apply Angel One coupon codes to get a free account.

Offline Process to Open Angel One Account

If your aadhar card is not linked with your mobile number, you can open an Angel One account by downloading offline forms, attach required documents, and courier the forms to Angel One head-office address.

Documents Required to Open Angel One Account

To open an Angel One Account, the documents required are

- Pan card

- Signature as per pan card

- Cancelled cheque

- Aadhar card

- Passport size photo

- Income Proof

What do we like about the Angel One Account Opening process?

- The sign-up and documents uploading process to open a demat account is easy and fast.

- Once you sign up to Angel One, you will get step by step instructions on how to complete the e-sign process online.

- You apply Angel One Promo Codes to open a free Angel One Account or get other benefits.

- You can connect with Angel One helpline to get help from their customer support in the Angel One Account Opening process.

Angel One Review – Account Opening Charges

The stockbroker collects a few charges to open the Angel One Account and from the clients.

Angel One charges to open demat account are shown in the table below.

| Demat services | Charges |

|---|---|

| Demat Account Opening Charges | Free |

| Demat Account Annual Maintenance Charges | Rs. 240 from 2nd year |

Angel One Review – Brokerage Charges

Angel One charges less brokerage compared to other full-service brokers. The Angel One brokerage charges will be a fixed amount irrespective of the trading turnover.

The brokerage will be charged for delivery based trades is zero. For all the other trades Rs 20 per executed order will be charged.

| Brokerage | Charges |

|---|---|

| Equity Delivery Trading | Free |

| Equity Intraday Trading | Rs. 20 per executed order or 0.25% (whichever is lesser) |

| Commodity Options Trading | Rs. 20 per executed order or 0.25% (whichever is lesser) |

| Equity Futures Trading | Rs. 20 per executed order or 0.25% (whichever is lesser) |

| Equity Options Trading | Rs. 20 per executed order or 0.25% (whichever is lesser) |

| Currency Futures Trading | Rs. 20 per executed order or 0.25% (whichever is lesser) |

| Currency Options Trading | Rs. 20 per executed order or 0.25% (whichever is lesser) |

Angel One Review – Trading Platform

Angel One provides a user-friendly service for trading and investing through Desktop web, mobile application, and desktop trading platform.

Here is the detailed information on the trading platforms which are used by clients after opening an Angel One Demat Account.

| Trading Platforms | Features |

|---|---|

| ANGEL SPEEDPRO App | 1. Real-Time rate updates. 2. Scrip-wise buys price, day’s gain/loss and overall profit/loss to view your holding portfolio at a glance. 3. Integrated news flash and research reports (check more on Angel One Research section). |

| ANGEL ONE TRADE App | 1. Track investments across all asset classes and for your entire family from a single place. 2. Access the latest market data, News as well as Angel research. 3. Easy to use & intuitive navigation with custom authentication for added security. 4. Multiple exchanges, hi-speed trading platform with streaming quotes. |

| ANGEL ONE MOBILE APP | 1. Live streaming prices 2. ARQ – Personalized advisory offering index-beating returns 3. Intraday charts with Indicators 4. Online Payment via 40+ Banks 5. 40 technical chart indicators and overlays to analyze each and every aspect of the stocks. 6. Personalized notifications for trades and ideas. |

| ANGEL BEE App | 1. Shows your current holdings and positionings across different financial products 2. Allows you to open a Big savings account which gives potentially higher returns as compared to a standard savings account. 3. The mobile app is sleekly designed and is optimal for beginner users as well. |

Angel One Review – Advantages and Areas of Improvement

Here are the advantages of using an Angel One account. There are a few areas of improvement that we have listed

| Advantages | Areas of improvement |

|---|---|

| Decent Trading Platforms | Average Customer Service |

| Strong Offline Presence | Limited Delivery Margin |

| Good Research Quality |

Our Angel One Experience Review

Angel One provides the best pricing, lowest brokerage plan, transparency, and it is one of the best full-service brokers in India.

The Angel One Account opening process is easy and fast. One can open Account within 10 to 15 mins after arranging all the required documents.

You get all scrip information across different segments on one page along with real-time market depth, bids and offers, charts, and 52-week low and high price.

You can trade on the move by using seamless user-experience on mobile applications & desktop trading platforms.

We have provided you with a detailed review of Angel One which provides their clients for better trading and investing experience.

Angel One Support

Angel One Customer Care Number: 02240003600

Angel One Email Support: support@angelbroking.com