Long buidup Short buildup – oi spurts

Table of Contents

Live FNO positions buildup

You can select Intraday stocks by seeing open interest positions being build up in the stock which trades in futures and options. Long buildup stocks, short buildup stocks, etc.

What is Open Interest

Open Interest refers to the total outstanding positions that are open till now in that particular derivative. It refers to currently active or Open contracts, that have not been settled yet.

Why would traders want to build new Open interest? well, they will expect the underlying to move in some direction and hence they will buy new contracts and increase open interest.

Similarly, when traders think that the current trend will be soon over, they start to square off the derivative contract of options or futures and hence open interest decreases.

What does Increase in Open Interest or decrease in open interest means?

Increase in open interest in futures contracts can mean that traders are expecting the current trend to remain in the stocks and hence they are building new open positions in derivatives to make profits.

The decrease in open interest indicates that traders are expecting the current trend to reverse of fade out and hence they are squaring off their derivative positions to book profits

What is a Long position?

A long or long position is bullish. It means the person is expecting the stock prices to go higher. So they are buying the stock first with a view to selling it later.

What is a Short position?

A short position is bearish. It indicates that the person is expecting the stock price to go lower and they sell the stock first with a view to buy it later.

Understanding Long and Short Positions

For a Long position, People buy at a low price and sell at a high price to make a profit. The concept is the same for Short as well. People are selling at a high price and will buy at a lower price. The only difference is that the sell action and buy action happens at different points.

Short sell occurs at a first high price and Buy occurs last at a low price. Sell occurs first and then Buy. For Long Buy occurs first at a low price and Sell occurs last at a high price. Buy occurs first and selling occurs.

What is Long buidup short buildup

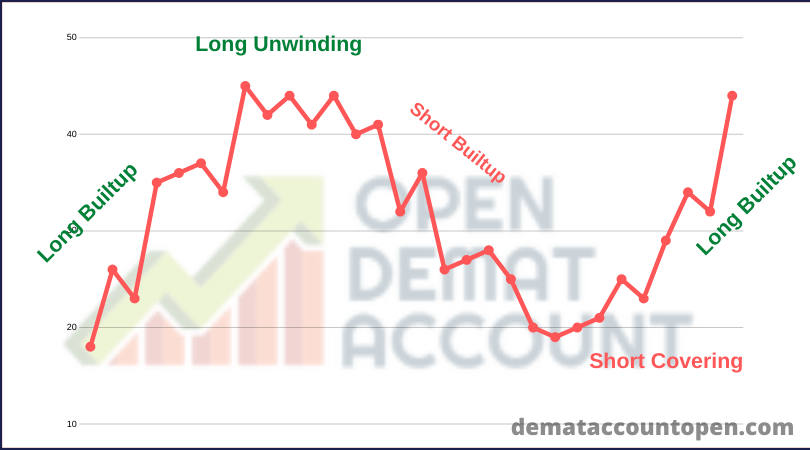

With the help of Open interest data, we can see positions that traders are making in futures and options stocks. The positions are usually classified as Long buildup, Short Buildup, Long Unwinding, Short covering

LONG Buildup: When traders are building long positions, it essentially means people are taking positions assuming the price will go up. This is characterized by an increase in open interest and increase in price

Short Buildup: When traders are building short positions, it means people are taking short positions, assuming the price will go down. This is usually characterized by an increase in open interest and a fall in price.

Long unwinding: This shows Long positions are now getting exhausted and people are starting to book profits, assuming rally is about to over. Long unwinding is marked by a fall in price and fall in open interest

Short covering: This means that Short positions are getting decreased and people are booking profits. Reversal can occur from here. Short covering is represented by an Increase in price and a fall in open interest.

How to select intraday stocks with Open interest

With the above live open interest positions, you can find stocks where traders are building long positions or short positions. You can also use Volumes for confirmation of Open interest positions. A stock with high volumes and an increase in open interest will usually rise in the coming days.

FAQs

What is a Long position?

A long or a long position refers to the purchase of an asset with the expectation it will increase in value a bullish attitude. A long position in options contracts indicates the holder owns the underlying asset.

What is a Short position?

A short position indicates that the person is expecting the stock price to go lower and they sell the stock first with a view to buy it later.

Open Best Demat account

Broker | Rating | Link to Open | |

|---|---|---|---|

Zerodha No.1 Stock Broker in India | ★★★★★ | ||

Upstox | ★★★★ | ||

Angel Broking | ★★★★ | ||

5 Paisa | ★★★★ | ||

StoxKart | ★★★★ |