A Demat account is a great tool for potential investors looking to be in stock market and/or those looking to make long-term and short term investments in India.

Demat accounts are a great way to invest in mutual funds without having to go through the hassle of paperwork or complex project reports.

This account provides multiple benefits for investors. It is especially useful for beginners as it allows them to be informed about market trends, analyze performance, and make sound investment decisions.

So if you’re looking to be in stock market and benefit from short-term investments, be sure to open a Demat account.

What Is Demat Account?

Table of Contents

A Demat account (Dematerialised Account) is a type of banking account that holds your investments in an electronic form. It is a repository for all financial instruments such as shares, ETFs, bonds, mutual funds, and other stocks.

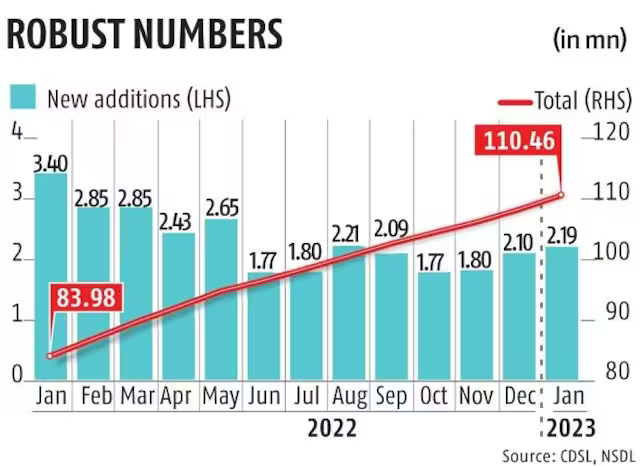

India is a majorly digitalised country, The size of its digital economy has grown from US$ 107.7 billion in 2014 to US$ 222.5 billion in 2019, So have the number of Demat accounts from 21.8 million in 2014 to 110 million in 2023.

With the Indian government continuously encouraging economic changes to promote a secure and efficient environment for trading stocks and other securities, it’s likely that the number of Demat accounts will skyrocket in the coming years.

You can buy sell shares using Demat account without having to store the certificates physically. This makes it easier and more efficient to track your investments, while also providing improved security for your holdings.

The analysis of Demat accounts and online trading has shown that the average income of individuals beyond the salary bracket of Rs. 5 to 15 lakhs holds the maximum number of Demat accounts.

It also shows that there is a growing number of individuals making investments in the stock markets and taking advantage of its potential returns. The number of Demat accounts, as well as online trading, is likely to rise further in the coming years. Thus, investing in stocks and mutual funds can be an attractive option for those who want to grow their wealth over time.

How Does A Demat Account Work?

A Demat account works to help the end user make seamless transactions with Dematerialized assets after validating their identity, verifying themselves as a credible and authentic buyer, and following other niche SEBI guidelines.

The expected steps of how a Demat account works are as follows:

- Opening a Demat account, use these documents to verify your candidature:

- PAN Card

- Address proof

- KYC details

- Once these documents have been verified by the broker or depository participant, a unique Demat account number is issued to the individual that will be used for all subsequent transactions.

- Once the Demat account is opened, the individual can start buying and selling securities such as stocks, bonds, ETFs, mutual funds, etc. on stock exchanges like BSE (Bombay Stock Exchange) or NSE (National Stock Exchange).

A Delivery Instruction Slip (DIS) is a document exchanged between buying and selling brokers during the purchase or sale of shares. It allows the broker handling the transaction on behalf of the investor to instruct their depository participant (DP) on how to execute a share trade.

Now, when a purchase transaction is executed through a Demat account, the shares bought are credited to the individual’s account. Similarly, when a sale transaction is executed, the shares sold are debited from the individual’s account and credited to the buyer’s Demat account.

The payment for the shares bought or sold is made through a linked bank account of the individual by debiting or crediting to this bank account accordingly.

Thus, a Demat account also serves as an excellent tool to manage your investments in the stock market.

It offers added convenience and security while buying and selling securities. Moreover, it is cost-effective as well since you do not have to pay additional charges for converting physical certificates into electronic ones.

Can Demat Account Be Transferred?

Yes, you can transfer your Demat account to another entity. The process of transferring a Demat account can be done in two ways: either through the transfer of a beneficial owner or by transferring the account itself.

If you transfer the beneficial owner, the process can be done within a few days. All you will need is to update your KYC details and submit the Demat transfer form.

Types Of Demat Accounts and their uses

There are three types of Demat accounts:

- regular Demat accounts

- repatriable Demat accounts; and

- non-repatriable Demat accounts.

Regular Demat account

A Regular Demat Account simply allows you to buy and sell stocks as well as other financial instruments. Angel Broking and Zerodha are doing a tremendous job in helping millions kick-start their financial journey with the hassle-free opening of a Demat account. In fact, they charge 0% brokerage, and even 0% interest during the first month on all profits.

It also helps lower transaction costs while allowing you to manage multiple shareholding portfolios. As opposed to repatriable Demat(which is next in line) accounts which allow you to transfer funds overseas and convert them into foreign currencies.

This type of account is suitable for regular investors who are looking to invest in Indian stocks and securities.

Repatriable Demat account

A Repatriable Demat Account is a Demat account that allows you to buy and sell securities outside India. It also allows you to repatriate funds from your investments outside India, provided certain conditions are met.

So, a repatriable Demat account is basically an equivalent of a regular Demat account but with an enabled ‘repatriation’ feature which allows investors to debit funds from the account even while they are living overseas.

This feature is not available in non-repatriable Demat accounts where funds remain locked in until the investor returns back to India and completes local formalities. With a repatriable Demat account, you can invest confidently without worrying about hindered exits. It is useful for NRIs or OCIs who are looking to invest in Indian stocks while living abroad.

Non-Repatriable Demat account

A Non-Repatriable Demat Account is a Demat account used to buy and sell securities within India only. It differs from regular and repatriable Demat accounts in that it does not permit the movement of shares in the international market. Instead, it focuses on investments within India’s domestic market and provides added security from local economic fluctuations.

With this account, investors can also access derivatives markets so as to make well-informed investment decisions and capitalize on potential opportunities offered by the broader Indian stock market.

Any funds earned from this type of account cannot be transferred outside India, even if you are an NRI or OCI. This type of account is meant for NRIs and OCIs who want to invest in Indian stocks, but do not require repatriation of funds.

5 core benefits of a Demat account

1. Seamless Transactions

With a Demat account, you can easily buy or sell shares without having to worry about paperwork such as filling out physical forms and signing documents. Additionally, you have automated access to your statement of accounts that serve as an organized ledger for tracking where money was spent and when shares were traded. All investments are held digitally as part of the Demat account resulting in a much faster process. This makes the whole process more efficient and saves you time.

2. Quicker Settlements

A Demat account allows quicker settlement of trades since you do not have to wait for the physical share certificates to be delivered or sent for clearance. When you buy or sell shares with a Demat account, transactions are completed almost immediately. This quickening of the settlement process reduces the time and effort spent in executing trades and allows investors to take advantage of market opportunities quickly.

3. They Are More Secure

By storing the shares electronically, it eliminates any risk of fraud or theft that is associated with physical certificates. Additionally, the securities are stored on a central server which minimizes the chances of data breaches as compared to physically storing them. Moreover, these accounts provide multiple layers of safety through authentication processes and the use of encrypted passwords.

4. Come At A Lower Cost

Transfer of shares from one account to another is completely free when dealing with a Demat account, as opposed to physical share certificates which require additional charges for conversion into electronic form. Additionally, Demat accounts incur minimal annual maintenance charges and This ensures that you do not have to pay extra fees in the long run.

5. Mandatory For Mutual Funds Investments

Demat accounts are also a great tool for short-term investments in India. You can use your Demat account to buy and sell mutual fund units of any company listed on the stock exchange, without having to submit any paperwork or complete complex project reports on mutual funds. This makes it much easier and quicker for investors to jump into the stock markets with short-term investments. To know more, you can find a comprehensive list of the best mutual funds for beginners here.

With minimal transaction costs, quick and safe transactions, and access to real-time market performance, a Demat account can be an invaluable asset for both beginner and experienced investors.

Leave a Reply