One of the first and foremost rules before starting to invest is to ask yourself ‘why’ you want to do it. Holding financial assets in the form of stock quantities and bonds form a crucial part of financial planning. The market today is so mature and sophisticated that rules (or best practices) can safely be identified when it comes to managing ‘dematerialised’ assets.

In this, we have explored 10 golden rules of investing to help you magnify your ROIs.

1. Build Your Financial Goals

Table of Contents

The initial step towards understanding your personal finance is to establish financial goals, decide the time frame in which those goals must be met, assess the degree of flexibility associated with those time frames, and finally, incorporate tax considerations.

Before you start investing, it’s also important to calculate how much risk you can handle. Open a Demat account with a trusted partner like Angel Broking and move to start asking yourself important questions such as:

How much can I invest every month?

Analyse your income and expenses. Make sure that you set aside enough money each month to cover all necessary costs such as rent/mortgage payments, utilities, groceries, and other bills. Any additional funds that are left over should be allocated toward your investment plan.

Why should I increase this number biannually?

Investing biannually can be a great way to leverage the power of compounding and benefit from the returns on your investments over time. Setting a biannual benchmark of raising your investment percentage by 10-20% can prove to be highly beneficial in the long run. Sure, it may keep you on the edge, but developing an investing discipline is critical in achieving long-shot financial goals.

For example in India, an individual who starts putting aside 10% of his salary every year can approximately double his portfolio in 18 years if he increases by 5% every year.

Not only does this provide an opportunity for long-term wealth creation but also helps offset inflation. Consequently, one should seek to gradually increase investment biannually until he or she feels comfortable with their goals.

Which bank/industry do I trust the most?

Do research on potential banks and industries to determine which one is most reliable for your investment needs. Also, consider whether or not they offer FDIC insurance and other protections that can give you peace of mind when entrusting them with your money.

2. Don’t Put All Your Eggs In One Basket

Diversification is an important part of investing as it helps to mitigate risk. Spreading your investments across different types of assets, such as exchange-traded funds (ETFs), small, medium, and large-cap stocks, mutual funds, cryptocurrencies, and gold – depending on how much risk you are comfortable with can reduce the possibility of severe losses.

While it does not guarantee a return on investment or protect against loss in volatile market conditions, diversifying can smooth out bumps along the way by providing security when some assets fall while others rise.

3. Dig Deep

Before you can start investing, it is important to conduct thorough research on uptrending stocks. Understand the company that you are interested to invest in. Take some time to read up on their background, management structure, and financials. This will help you understand the risk associated with various investments and make more informed decisions.

When it comes to investing, staying up-to-date with the latest news and updates on different markets can help you make better decisions. Watching how stock prices react to events in different sectors can give you insight into which stocks might be a good fit for your portfolio.

Additionally, tracking macroeconomic indicators like GDP growth, inflation rate, currency volatility, and global trade movements can provide the necessary context for making good financial decisions.

4. Take A Break And Reconsider Decisions Every Now And Then

Markets change every day, and keeping up with trends can get overwhelming. A highly volatile market tends may make you susceptible to impulse-driven and thought-less decision-making. It is, therefore, important to take a step back every once in a while and re-evaluate your holdings.

Taking some time away from investing and keeping tabs on the latest developments of different markets can help you stay abreast of the changing conditions and make sure your portfolio remains well-balanced and profitable. It will also buy you some time to research with a bird’s eye view and let your interdisciplinary knowledge guide you.

There are a few simple measures that can help make investing more comfortable. For example, if you’re investing from (and in) India, make sure you’re staying up-to-date with Indian investment metrics like the Sensex, Nifty50, and the established top blue chip mutual funds.

Studying the financials of different companies can help investors understand the risk associated with various investments.

5. What Works For Them, May Not Work For You

It is important to remember that investment advice can be helpful, but too much of it can cloud your decision-making. Remember that investment decisions should ultimately come down to you and the goals you have set for yourself. That being said, seeking out professional investment advice from a reputable financial advisor or investment counsellor can be especially beneficial for investors who may not have the time or resources to conduct research on their own.

Doing too much research and taking too many opinions can make it difficult in making quick investment decisions. In turn, it may lead to confusion and may compel you to make unnecessary risks.

Let’s say you want to start investing as a college student or want to start building a retirement fund from a young age, you would be seeking out various types of problem-solutions.

Now, there are plenty of financial one-fits-all templates out there when it comes to investment advice for senior citizens, and fresh graduates but it may not work for you. We strongly suggest you to rather trust a qualified professional to build a beneficial foundation for long-term investment success.

6. Think Long-Term

The key factor to consider when investing is the long-term potential of your investments. It is important to look for stocks and companies that have an upward growth trajectory, With a long-term outlook, investors are more likely to experience a steady return on their investments rather than trying to time the market.

Investing in stable industries, such as Information Technology (IT) FMCG (Fast-moving consumer goods) Housing finance companies, and Automobile Companies can provide diversification and steady returns over time. By keeping an eye on macroeconomic indicators and researching the performance history of different stocks and markets, investors can make more informed decisions and look for uptrending stocks that can provide long-term growth potential.

Additionally, staying up-to-date with the uptrending stock list will have your portfolio well-positioned to benefit from the growing trend of investment.

7. Evaluate Your Investment Strategies Periodically

Create metrics to evaluate your stock investment performance.

- Profitability: If you are a new investor, cap your profitability to at least 20%. By the end of the first year of investing in mutual funds and stocks, check if your profits are 20% or more. If not, revise your plan fundamentally. If yes, then figure out ways to maintain this return and amplify it in the near future.

- Annualised Return: This is similar to profitability.

- % of financial goals met (trimester-wise)

Building long-term wealth and financial freedom is Mutual fund investments while reducing mutual fund investment risk, the mutual fund portfolio should include funds that have long-term growth potential.

8. Automate Investments. It’ll Pinch Less.

Automate your deductions using Zerodha. SIPs can get auto-deducted using simple e-mandate features. In 2 easy steps, thanks to sophisticated tech and planning, you can register an e-mandate and simply schedule your deductions.

You see, automated investments are those that are made automatically on a regular basis, such as monthly or quarterly, reducing the number of clicks and manual bank transactions.

- This allows you to invest in a consistent manner without having to remember to execute trades every month.

- it takes the emotion out of investing and helps you stick to your plan without worrying about market fluctuations or other external factors.

- Automated investments also help you budget better by allowing you to restrict your monthly spending, enabling you to make more informed financial decisions each month rather than splurging on impulse purchases.

Automated investments are also known as a dollar-cost averaging plan. With a dollar-cost averaging plan, you can achieve your financial goals by running your investments on auto-pilot and help you buy a stock at lower prices than when it is done manually.

9. Invest In Industries That Perform well

Investing in industries that you believe in is an important part of the investment journey. Choosing stocks from sustainable, green industries such as renewable energy, eco-friendly technology, and clean transportation can help provide financial returns while helping to promote a healthier planet.

Investors who want to benefit from this opportunity can invest in Indian green energy share lists that provide access to some of the top green energy companies in India.

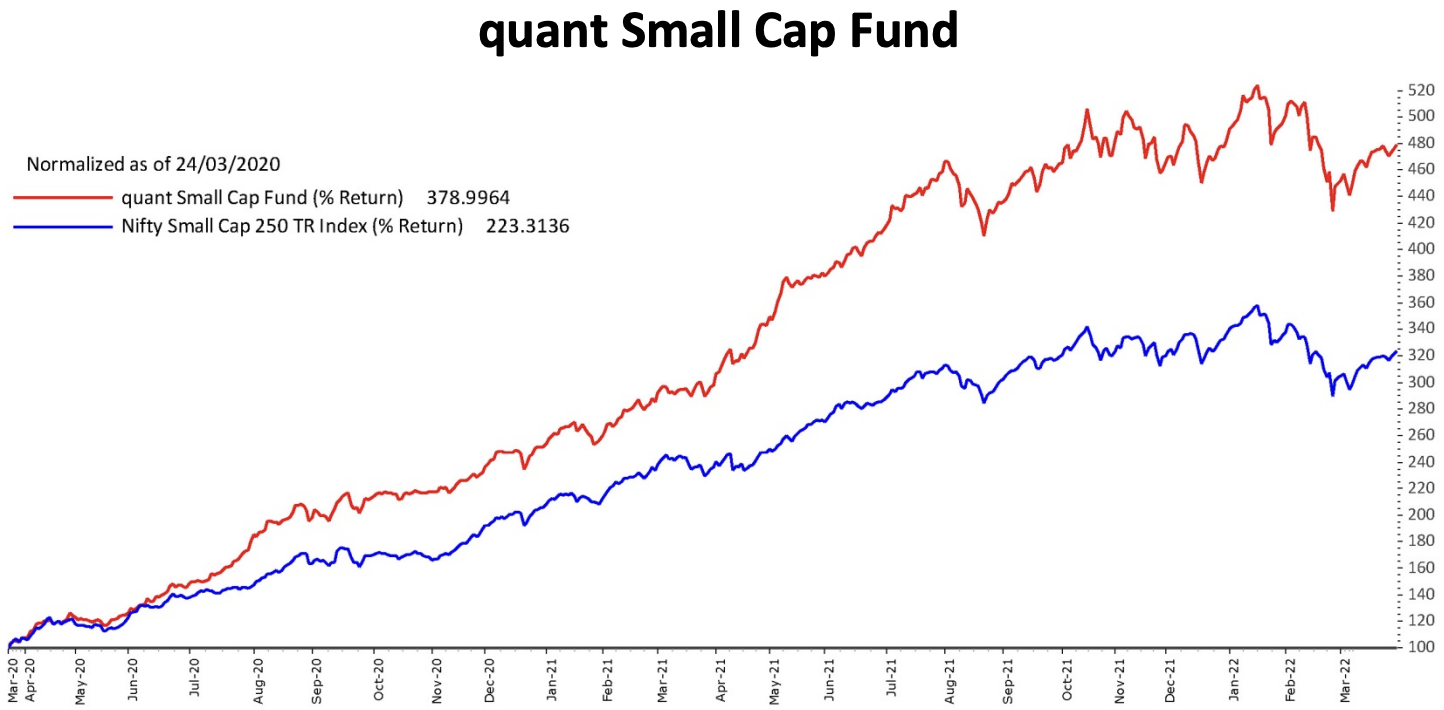

Invest in small-cap funds for higher yields.

Small-cap funds are a great way to generate high yields. These smaller companies tend to be more volatile and offer greater potential returns than large-cap funds, making them an attractive option for investors looking to diversify their portfolios. Examples of high-yielding small-cap funds in India include Quant Small Cap Fund with an ROI of 36.60% in the past 3 years, In the past 5 years this mutual fund has generated a CAGR of 21.73% while the average of this category is 12.1%.

10. Get Creative. Early Adopters Benefit The Most

Most opt to take the safer route of following similar stock investments as the herd. However, doing this could end up being more costly in the long run than taking the time to do some independent research into unpopular stocks.

The Indian stock market is home to many firms and their underlying stocks that are often overlooked, yet could hold great potential for investments. By researching and investing in these lesser-known stocks carefully, investors can take advantage of purchasing shares at relatively low prices and reap greater rewards down the line.

Relying on others when it comes to investing could lead you down a perilous path as it lures away from significant due diligence; so taking the time to assess your own unique investments instead can be far more beneficial in the long term.

Get creative and use indicators such as morning star ratings. It is a widely used third-party rating system that measures the risk and returns of mutual funds. It assigns a rating from one to five stars based on past performance and volatility, so when evaluating any type of fund it’s important to look back across that timeframe. Funds that perform in the top 10% within their category receive 5 stars, 4 stars for the next 22.5%, 3 stars for the middle 35%, 2 stars for the next 22.5%, and 1 star for the bottom 10%.

It helps investors compare different funds and determine which might be best for them. By looking at the Morning Star rating, investors can make more informed decisions when selecting mutual funds.

Conclusion

In summary, investing comes with a certain amount of risk but there are ways to minimize this. By understanding the different types of funds and their associated fees, you can make more informed decisions about which funds are right for you. Additionally, by looking at third-party ratings such as Morning Star, investors can compare different funds and determine which may be best for them. Investing with knowledge and confidence can help you create a secure financial future.

A thorough understanding and insight into the crucial information on investing based on your life stage can help you save more and eventually help you prepare better.

Leave a Reply