Top 10 Demat Account in India – Open Best Demat Account in India

Are you ready to take control of your financial future and start investing in the stock market?

Opening a Demat account is the first step towards building a successful investment portfolio.

Here are a few reasons why you should consider opening a Demat account and start investing in the stock market:

|

No 1 STOCKBROKER IN INDIA Zerodha Free equity & mutual fund investments | Flat ₹20 intraday and F&O trades |

Rating ★★★★★ |

APPLY NOW |

|

GET FREE DEMAT ACCOUNT UPSTOX Fix brokerage of Rs. 20 per trade |

Rating ★★★★ |

APPLY NOW |

|

GET FREE DEMAT ACCOUNT Angel One 0 Brokerage on Equity Delivery | Rs 20 per order for Intraday and F&O trades |

Rating ★★★★★ |

APPLY NOW |

Diversification: A Demat account allows you to invest in a wide range of securities, including stocks, mutual funds, and bonds. This diversification can help you manage risk and potentially earn higher returns over the long term.

Convenience: With a Demat account, you can easily buy and sell securities online, at your own convenience, from the comfort of your own home. This eliminates the need for physical documents and makes the process of investing faster and more convenient.

Potential for high returns: The stock market has the potential to generate high returns over the long term. By investing in a diverse portfolio of stocks and other securities, you can potentially earn higher returns than you would with other types of investments.

Professional management: Many Demat accounts offer professional management services, allowing you to take advantage of the expertise of financial professionals. This can be particularly helpful if you are new to investing or don’t have the time or knowledge to manage your own portfolio.

We will help you select the Best Demat and trading account in India by comparing all the top Stock brokers in India.

Many brokers allow you to Open Demat account online easily and get started on trading fast. Just click on Demat account opening link and open instant account

Check the Ratings of Top 10 Share Brokers in India in 2023:

| Rank | Broker | Ratings | Demat Account Opening Link |

|---|---|---|---|

| 1 | Zerodha | 9.1/10 | Open Free Account |

| 2 | UPSTOX | 8.4/10 | Open Free Account |

| 3 | Angel One | 8.2/10 | Open Free Account |

| 4 | ICICI Direct | 8.2/10 | Open Free Account |

| 5 | Sharekhan | 7.9/10 | Open Free Account |

| 6 | StoxKart | 7.5/10 | Open Free Account |

| 7 | IIFL | 7.1/10 | Open Free Account |

| 8 | Motilal Oswal | 7.0/10 | Open Free Account |

| 9 | HDFC Securities | 6.8/10 | Open Free Account |

| 10 | 5Paisa | 6.7/10 | Open Free Account |

You can contact us to Open Demat Account Online and we will help you select the best Demat and trading account. Call us on 9838479931 for help

How to Open Demat Account Online

To open a Demat account online in India, you will need to follow these steps:

1. Choose a depository participant (DP): A DP is a financial institution that offers Demat services. There are several DPs to choose from, including banks, brokers, and other financial institutions. You will need to choose a DP that suits your needs and meets your requirements.

2. Gather required documents: To open a Demat account, you will need to provide certain documents, such as proof of identity, proof of address, and other supporting documents. The specific documents required will depend on the DP you choose.

3. Fill out the application form: Most DPs will have an online application form that you will need to fill out to open a Demat account. The form will typically ask for personal information, such as your name, address, and contact details.

4. Submit the application: Once you have completed the application form and gathered all the required documents, you will need to submit the application to the DP. This can usually be done online or by mail.

5. Wait for approval: After you have submitted your application, the DP will review it and determine whether you are eligible to open a Demat account. If your application is approved, you will receive confirmation and instructions on how to complete the account opening process.

It’s important to note that each DP may have different requirements and processes for opening a Demat account. Make sure to carefully read and follow the instructions provided by your chosen DP.

How to Open Zerodha Demat Account - latest 2023 Process

How to Open Upstox Demat Account - latest 2023 Process

How to Open Angel One Demat Account - latest 2023 Process

How to Open StoxKart Demat Account - latest 2023 Process

How to Open SBI Demat Account - latest 2023 Process

You would need to keep ready the documents required to open a Demat account online and click on the above links to open a trading account with the best discount brokers in India.

If you have any issue with the Demat account opening, Click to Whatsapp us below

How to Start Investing or Trading in Stock Markets?

We know that stock markets are one of the best ways to create Wealth in long term.

Also, many people make money from the stock market by trading in it. You can also do the same by Investing or trading in Stock market.

If you are new to the stock market, you need to have a Demat account to start investing and trading online.

We help you to select the Best Demat account in India according to your requirements. There are different brokers like Full-service brokers and discount brokers. Full-Service brokers provide regular booking services as well as advisory services.

The new-age discount brokers provide good platforms and lower charges but do not provide advisories to keep costs low.

You can select a Discount broker if you want to do trading or investing on your own.

If you need an advisor or phone support, you can go with a regular broker.

How to select the Best Stock Broker for Demat Account Opening?

Selecting broker can be confusing. However, there is a systematic approach to follow while selecting Top stock broker in India to trade and Invest.

Now let’s be obvious that no broker is best for everyone.

People have different preferences, Trading styles, and trust level; hence, they will choose brokers based on their convictions. Below are the points on which you can select best stock market, brokers

- Brokerage charges

- Trading /Investing platforms and Tools

- Customer Service

- Ease of Use

- Account Opening Charges

- Research and Education

- Margins and leverage offered.

We usually look for brokers with lower brokerage charges, Good and easy-to-use platforms and tools, Good customer service, Low account opening charges, and good Research and education.We help you select top stock brokers in India based on the above parameters

Best Demat Account In India - Online Brokers

To know about the best Demat account in India, I have curated a list of Demat accounts from registered stockbrokers, then ranked them by a set of parameters.

Here is the list of the Best Demat Account in India

- Zerodha Demat Account

- Upstox Demat Account

- Angel One Account

- 5 Paisa Demat Account

- ICICI Direct Demat Account

Every broker has some advantages and disadvantages. Discount brokers focus on improving their trading platforms while full-service brokers focus on improving customer service.

5 Best Demat Account in India

Here is detailed information on the 5 Best Demat Account in India.

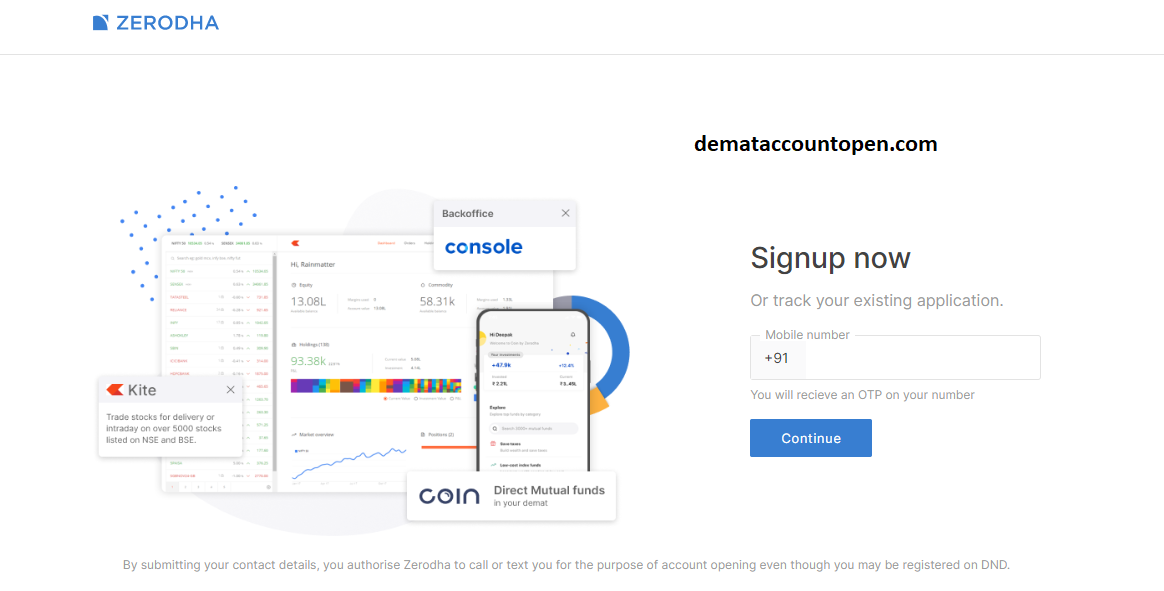

#1. Zerodha Demat Account - Best Overall Broker for Demat Account

Zerodha was established in the year 2010 by Nitin Kamath and is the greatest discount broker in India. It has over 80 million clients and adds to over 10% of everyday retail trading volumes over the Indian Stock Market.

Zerodha is in the first position compared to other discount brokers by volume, a number of customers, and growth. It is very simple and easy to understand the Zerodha brokerage structure.

Zerodha charges for Account Opening are Rs 200 for equity and Rs 100 for commodity. The annual maintenance charge for a Demat account is Rs. 300.

Zerodha brokerage charges are Rs 20 rupees or 0.03%, whichever is lower per every executed trade and equity delivery trading is free.

Zerodha provides investment and trading services in equity, mutual funds & commodities.

Zerodha Trading Platform owns an online mobile and web trading application named “KITE” which is the best trading platform in India and back-office software called “Console”.

All trading software applications including trading terminals, websites, and mobile trading are available free of charge. Zerodha also provides other products like Zerodha Coin, Zerodha Sentinel, Zerodha Pi, and Zerodha Varsity.

Zerodha Demat Account Advantages

- User-friendly trading platform

- Brand value

- Low brokerage

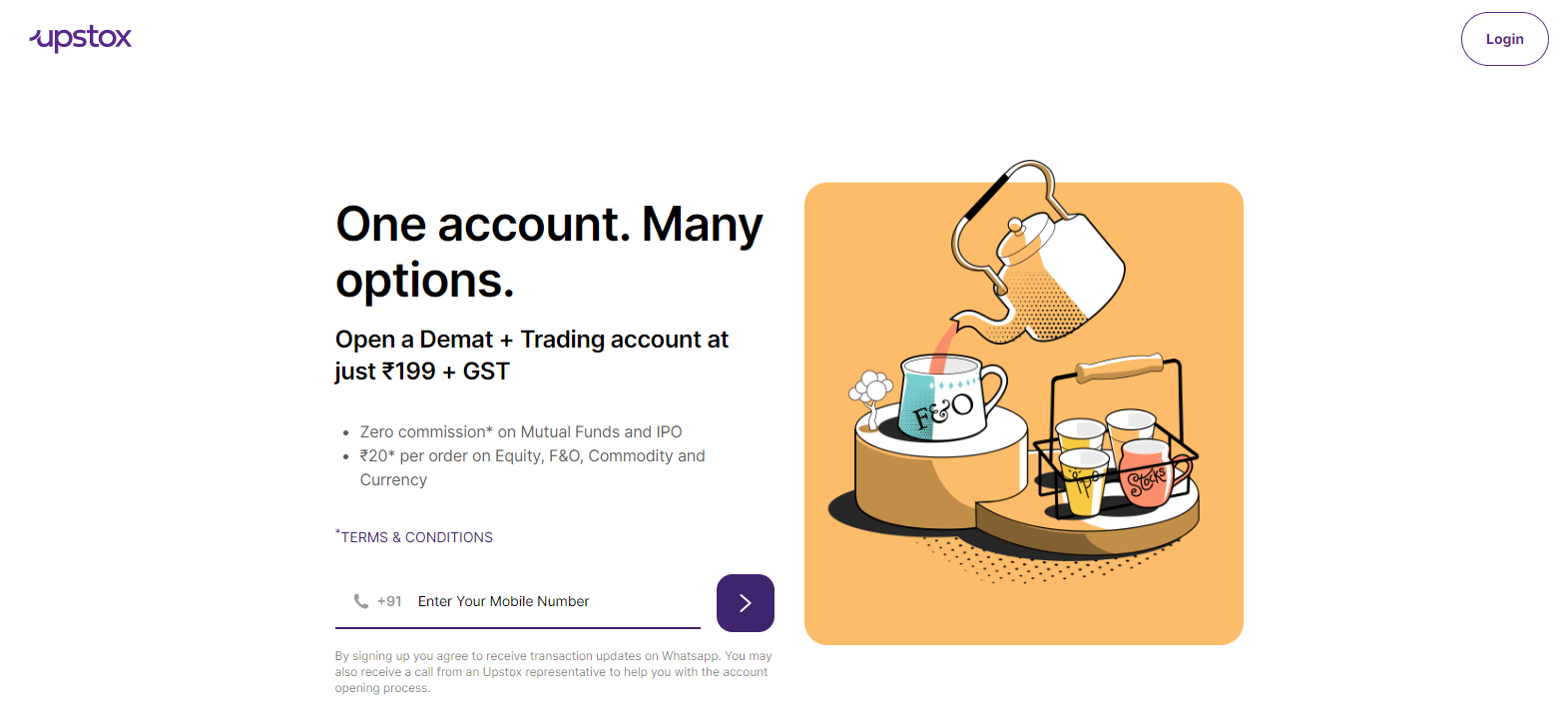

#2. Upstox Demat Account - Cheapest Brokerage Charges

Upstox is a discount broker that started as RKSV in 2012 and rebranded to Upstox in 2015. It is supported by a group of investors like Kalaari Capital, Ratan Tata, and GVK Davis.

If you are willing to open both the Equity and Commodity account, the charges are free but you need to pay brokerage credit while the account opens. The annual maintenance charge for a Demat account is Rs. 150.

Upstox charges brokerage of 20 rupees or 0.05%, whichever is lower per every executed trade and equity delivery trading is free.

Upstox provides investment and trading services in equity, mutual funds & commodities. Upstox Equity and Derivative trading accounts help clients to trade in stocks, F&O, currencies, indices, and others.

Upstox Trading Platform owns an online mobile and web trading application named “Upstox Pro” which is the best trading platform in India and back-office software named “Back-office Upstox”.

All trading software applications including trading terminals, websites, and mobile applications are available free of charge. UpstoxMF has all types of investment options for you. You can purchase the ones focused on saving taxes.

Upstox Demat Account Advantages

- Fast paperless account opening

- Priority brokerage

- Free delivery trading

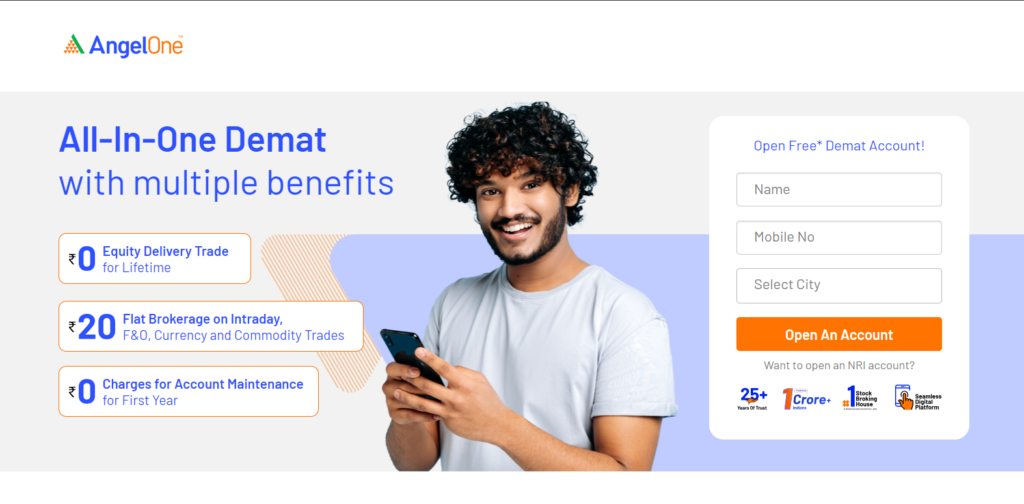

#3. Angel One Demat Account- Great Customer Support

Angel one Pvt Ltd is one of the leading broking houses in India and has been in the business since 1987.

Angel One is a financial services company in India that offers a range of investment products and services, including a Demat account.

A Demat account is an account that allows you to buy and sell shares and securities online, without the need for physical documents.

Some features of Angel One’s Demat account include:

- Online access: Angel One’s Demat account can be accessed online, allowing you to buy and sell securities at your own convenience, from the comfort of your own home.

- Wide range of investment products: Angel One’s Demat account allows you to invest in a variety of securities, including stocks, mutual funds, and bonds. This allows you to diversify your portfolio and manage risk.

- Professional advice: Angel one offers professional investment advice to help you make informed decisions about your investments.

- Low brokerage fees: Angel One charges low brokerage fees for its Demat account services, making it affordable for investors of all sizes to participate in the stock market.

Overall, Angel One’s Demat account is a convenient and cost-effective way to buy and sell securities in the stock market.

If you are interested in investing in the stock market, you may want to consider opening a Demat account with Angel One.

Angel One Account opening charges are free for equity and currency, in which you can buy/sell shares & derivatives on NSE and BSE.

The Annual maintenance charges for the Angel One account opening are Rs. 0 for the first year then Rs. 240 per annum.

Angel One charges a flat rate brokerage charge of Rs 20 per executed trade and equity delivery trading is free.

Angel One also offers a free mutual fund investment platform which is the Angel BEE application.

Angel One Demat Account Advantages

- Fast paperless account opening

- Efficient Trading Platforms

- Free delivery trading

- Strong Offline Presence

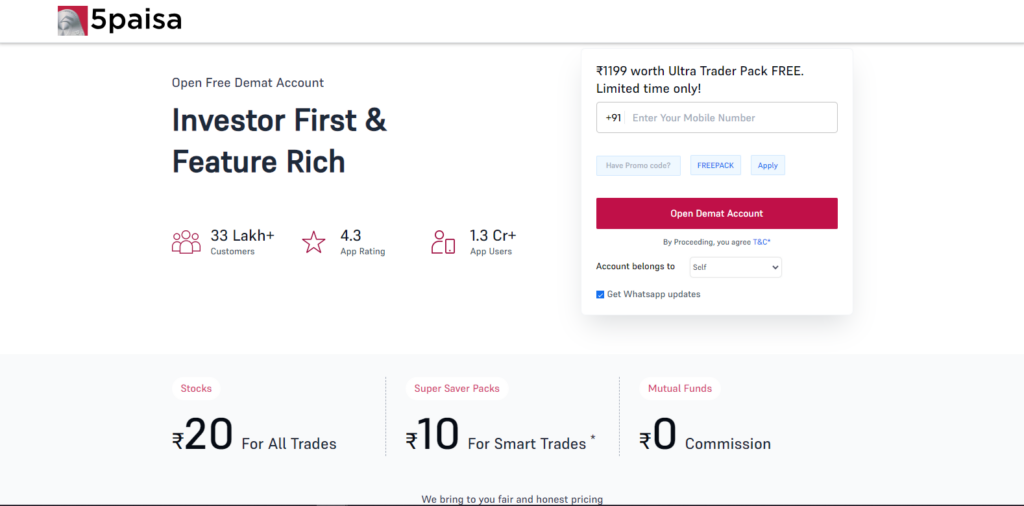

#4. 5Paisa Demat Account - Free Brokerage

5Paisa was launched in the year 2007 is a part of IIFL and offers the least valuable stock broker in India. IIFL launched 5Paisa to offer a lower brokerage for its clients and to contend with the fast-developing discount broking industry.

To open a Demat and trading account in 5 paise, the account opening charges are Rs. 500 for both equity and commodity. The annual maintenance charges are Rs 45 per month (only for months when you trade).

5Paisa provides free trading in equity and flat brokerage in other segments. The brokerage charges for 5Paisa are Rs 10 per trade for Intraday Trading and equity delivery trading is free.

5 paisa provides investment and trading services in equity, mutual funds & commodities. 5 paisa Equity and Derivative trading accounts offer clients to trade in stocks, F&O, currencies, indices, and others.

5 paisa offers trading platforms for free as a mobile application and web-based trading, it also offers a free mutual fund investment platform which is the 5 Paisa MF platform.

5Paisa Demat Account Advantages

- The lowest brokerage compared to other brokers.

- Low maintenance charges.

- Offers Research Tips and Calls

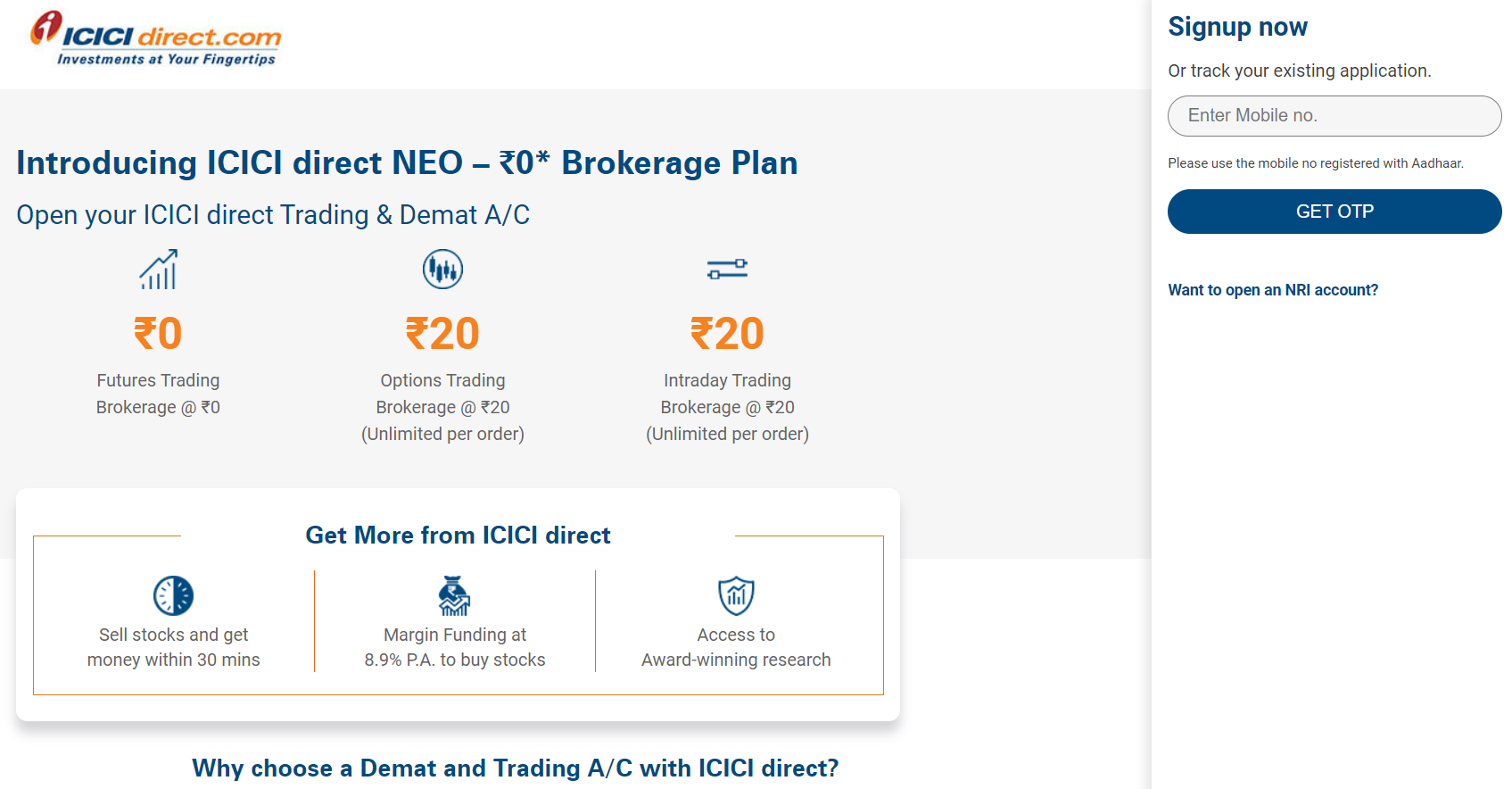

#5. ICICI Direct Demat Account - largest stock brokerage company

ICICI direct is one the largest stock brokerage companies having more than 20 Lakh customers. ICICI Direct provides a wide range of services and investment options which includes Investment in equities, derivatives, mutual funds, IPO, NCD & bonds, ETF, and currency.

The Icici Direct Demat Account Opening Charges are Rs. 975 depending on the scheme. The Annual Maintenance Charges are Rs 700 (1st year free).

They offer 3 different types of brokerage plans to suit the trading profile of the trader/investor.

I – Secure Plan: A fixed percentage of brokerage of 0.275% for Intraday and 0.55% for delivery-based trades is charged irrespective of turnover per quarter (Total traded value).

I – Saver Plan: A variable percentage of brokerage 0.25% to 0.75% for Delivery and 0.125% to 0.375% for intraday-based trades is charged based on the turnover per quarter. Higher turnover. lower will be the brokerage slab.

Prepaid brokerage Plan: This plan is similar to Sharekhan, you pay upfront brokerage of 0.45% to 0.12% for both intraday and delivery-based trades to avail of the reduced brokerage slabs.

Trade Racer Web is a web-based platform with which you can do all the trading and investing activities. The web platform is accessible from any browser.

Trade racer Desktop is an Installable trading platform with features like live-streaming quotes & research calls and an integrated fund transfer system.

Advantages of ICICI Direct Demat account

- 3-in-1 demat account, easier flow of funds

- One of the most reputed names in the brokerage industry.

- One-stop solution for all investments and also insurance

Demat Account Opening Charges

Demat account opening charges are different for different brokers.

Usually Demat account opening charges range from 250 rs to 700 rs depending on the broker you chose. However , we have many offers where you can open totally free Demat accounts of all brokers online.

You just need to contact us using the form below or call us at the number given on top of the page for availing this offer.

Lets see the current demat account opening charges of stock brokers in India

| Rank | Broking House | Demat Account Opening Charges | Account Opening Link |

|---|---|---|---|

| 1 | Zerodha | 300 rs | Open Free Account |

| 2 | UPSTOX | 249 rs | Open Free Account |

| 3 | ICICI Direct | 650 rs | Open Free Account |

| 4 | Angel One | Free | Open Free Account |

| 5 | Sharekhan | 500 rs | Open Free Account |

| 6 | StoxKart | Free | Open Free Account |

| 7 | IIFL | 500 rs | Open Free Account |

| 8 | Motilal Oswal | Free | Open Free Account |

| 9 | HDFC Securities | Free | Open Free Account |

| 10 | 5Paisa | Free | Open Free Account |