Zerodha Review

Table of Contents

In this blog, we will provide you with a detailed Zerodha Review of Free Demat Account Opening, Zerodha Brokerage Charges, Zerodha Demat Account opening process, and various Zerodha apps for trading, etc.

We will also review the Customer care and Zerodha AMC Charges for this Discount Stock Broker.

But before that, let’s take a sneak peek into Zerodha Demat Account which heading towards the largest stockbroker in India today in the Online Stock Market world.

Let’s now look at Zerodha Review on the following Parameters

Zerodha Review of Free Demat Account

Zerodha Demat’s account is easy to open with a simple online account opening process. Given that SEBI regulates it, this Demat account is safe and reliable to use.

Zero brokerage charges for buying and selling shares in equity delivery help you to save lots of money while buying or selling shares.

The disruptive brokerage charges model with Free Equity delivery, Free Direct Mutual Funds in Zerodha Coin, and Flat rs 20 per trade price have definitely made Zerodha the number one Discount Broker of India.

Want to know how much money you can save with this Demat account?

Let’s look at the maths below.

Imagine, you buy 1 share each from 10 different companies

With Zero Equity delivery trading charges, you end up paying Rs 0 as Zerodha Brokerage

Now, let’s see if you perform 10 trades in a month.

With Rs 20/ trade flat pricing, you will only pay Rs 200 as Zerodha BrokerageNow, this is huge savings if you open a Zerodha Demat Account

Zerodha Account Opening Process

Zerodha offers an Online and Offline Account Opening Process.

The online process to Open a Zerodha Demat Account is easy and straightforward.

- Complete your Zerodha Signup here

- Enter PAN details in Zerodha login

- Pay Account opening fees and verify details using Aadhar.

- Esign with OTP and you will be good to go.

- The offline process to open a Zerodha account takes up to 4 days and requires you to send physical documents.

Zerodha Charges

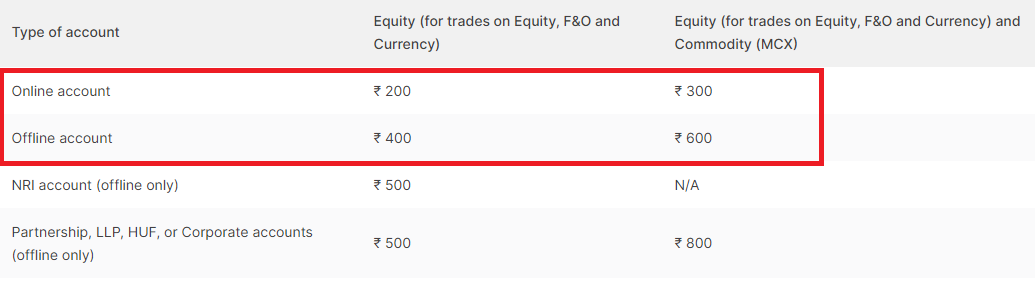

Zerodha charges Rs 200 for Online Account Opening for trades on Equity and Rs 300 for Equity + Commodity accounts.

Zerodha charges Rs 400 as an offline account opening for Trades on Equity, F&O, and Currency and Rs 600 for Equity + Commodity account.

If you look at the benefits that come with this Demat account, you will be surprised to know that this charge is minimal and the benefits that come are huge as compared to other stockbrokers in India. Definitely, it is a transparent stockbroker.

Tip – Always prefer the online Zerodha Account Opening process and you can save Rs 300

Zerodha Brokerage Charges

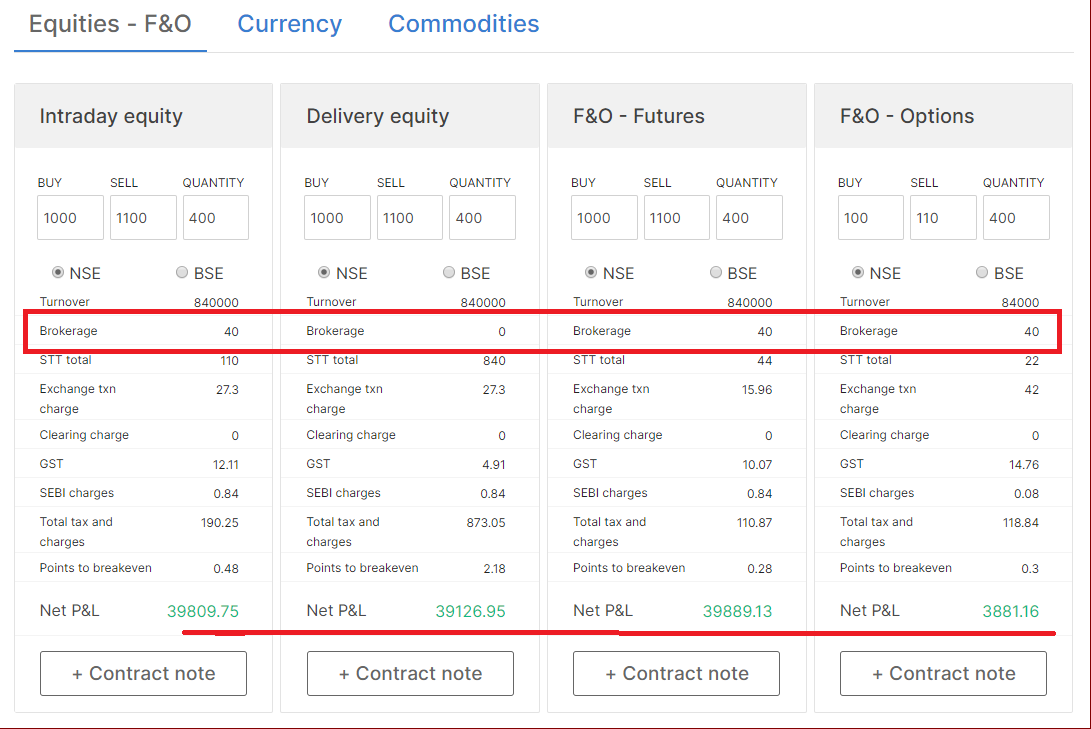

Zerodha charges a maximum brokerage of Rs. 20 per trade for all segments and Zero rupees for delivery trading, which is less compared to many other stockbrokers

It really helps you to save big on zerodha brokerage charges.

Zerodha Brokerage Calculator

If you only stick to buying and selling shares using Zerodha Account, you will end up paying Rs 0 as brokerage.

yes, that right.

If you opt to perform trading with Zerodha, you will only pay Rs 20.

yes, that right again

Zerodha charges a maximum brokerage of Rs. 20 per trade for all segments and Zero rupees for delivery trading, which is less compared to many other stockbrokers. It really helps you to save big on brokerage charges.

You might want to access the live Zerodha Brokerage Calculator.

However, for your ease, we have calculated the brokerage amount that you need to pay for 400 quantity of buy and sell as Intraday equity.

Related Post: How to use Zerodha Margin Calculator

Zerodha AMC Charges

For equity accounts, AMC is Rs 75 + 18% GST which gets deducted from your Demat Account balance every quarter. Zerodha does not charge any AMC for the Commodity account.

Zerodha AMC charges (Annual maintenance) is the charge to maintain your Demat Account

Zerodha Trading Platform

Zerodha provides one of the best and most user-friendly trading platforms for their clients. You can easily trade by using this Zerodha Trading Platform on your mobile, desktop application, or by desktop web.

Following are Zerodha Trading Platforms that are user-friendly and easy to use

Related Post: How to Buy and Sell shares in Zerodha

Zerodha Kite Review – Most simple yet powerful trading platform

Kite 3.0 is a web-based trading and investment platform. One can use Zerodha Kite 3.0 to execute the trade using browsers on Mobile or desktop.

Zerodha Kite 3.0 gives you to access 90,000+ stocks and F&O contracts across major exchanges.

With a clean and simple-to-use web application, Zerodha allows you to quickly search your favorite stocks with no delay.

Kite 3.0 gives you advanced access to level 3 data share deeper insights into market liquidity and allows you to develop advanced intraday trading strategies.

In this blog, we will provide you with a detailed Zerodha Review of Free Demat Account Opening, Zerodha Brokerage Charges, Zerodha Demat Account opening process, and various Zerodha apps for trading, etc.

We will also review the Customer care and Zerodha AMC Charges for this Discount Stock Broker.

But before that, let’s take a sneak peek into Zerodha Demat Account which heading towards the largest stockbroker in India today in the Online Stock Market world.

Let’s now look at Zerodha Review on the following Parameters

Needless to say, Kite 3.0 Web Application is FREE for Zerodha clients

Kite by Zerodha Mobile App Review

Kite by Zerodha is one of the most advanced trading apps in India available for both Android and iOS mobile phones.

One can easily access the live market data using the Kite app. Easy Navigation definitely eases the Zerodha usability

With easy Buying and Selling options, Kite by Zerodha App helps you to smartly manage your portfolio, create multiple watchlists of your favorite stocks and keep track of your Holdings

Zerodha App has advanced charts with over 100 indicators. All this comes with a smart user-friendly UI. You can easily trade in various Order Types in Zerodha Kite Application.

Zerodha Kite App has two-layer security – this means, all your data is safe within your mobile

Zerodha Customer Care Review

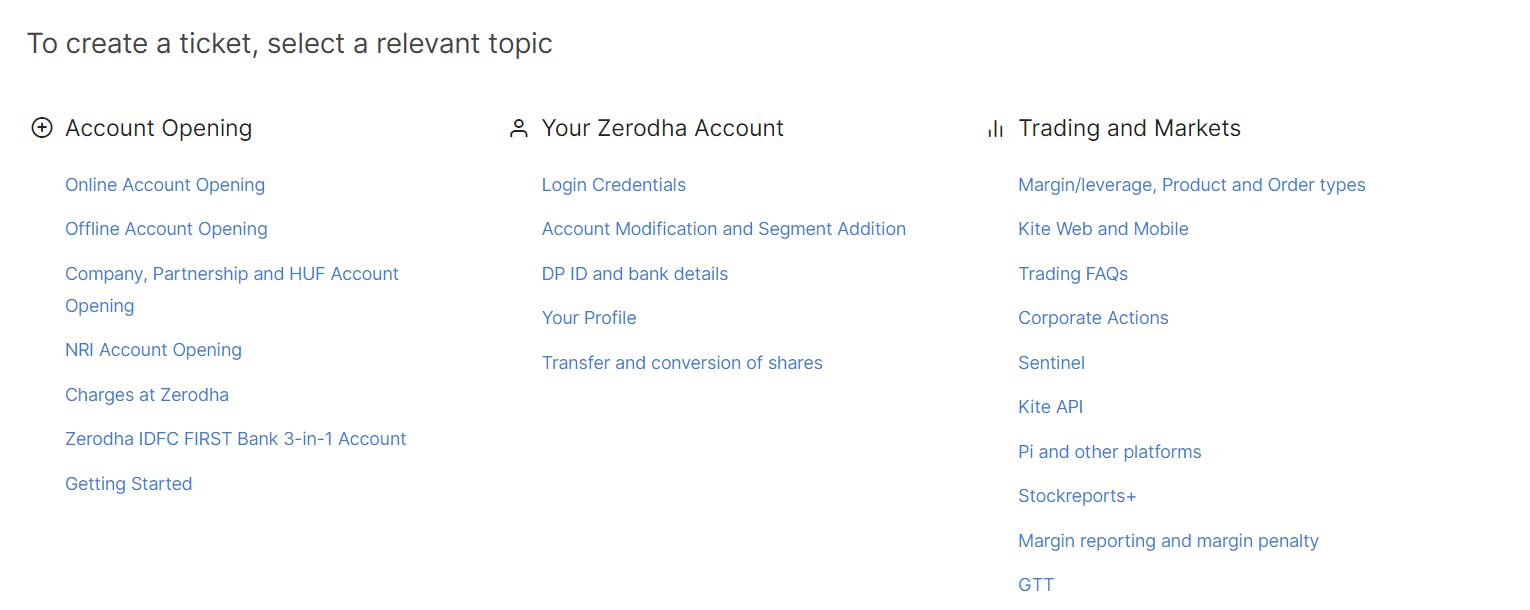

It has a fantastic support portal to help its clients. Our personal experience says that they address the issues on priority. Zerodha also has dedicated on-call support

08049132020 is the Zerodha Customer Care number for queries.

Our Zerodha Review Experience – India’s Best Stock Broker

Zerodha Account Opening process is quick and easy.

Trading platforms like Kite Web, Kite Mobile, and Zerodha Console for Analytics are certainly progressive with easy-to-use UI and multiple features

Users can buy an IPO or go for Mutual fund investment using a single Zerodha Account

With flat pricing, discount broking, Safe Demat account, and transparency, Zerodha Demat Account is a certain market leader today

Free benefits like Zerodha Varsity offers free Stock market education to help you learn everything in the stock market.

Given the number of benefits the Zerodha Demat Account provides, the Zerodha Demat account is a definite winner among the best stockbrokers in India

Zerodha Demat Account – Pros and Cons

| Pros | Areas of Improvement |

|---|---|

| Delivery trading is free for Equity. | At times, one can face application down during trading hours. |

| Low AMC Charges for Demat account No AMC charges for Commodities account | The margin provided is low. |

| Zerodha Brokerage charges is flat Rs. 20 per trade while Equity delivery is totally Free | |

| Easy Online account opening procedure | |

| Zerodha Trading Platforms like Kite 3.O and Kite App is easy to use with seamless user experience | |

| Zerodha console generates meaningful reports that help to keep a hawk-eye on the portfolio of investments and monitor Profit and Loss | |

| A single platform to invest in IPO and SIP Mutual Fund investments using Zerodha Console | |

| Regular email of Annual Global Statement to view transactions executed by you during the financial year along with the brokerage, taxes, and charges paid | |

| Free access to Zerodha Varsity - the free resource to learn Stock Market in English |

Zerodha Demat Account FAQs

What is Zerodha IDFC FIRST Bank 3 in 1 account?

It is a single account offered by Zerodha that includes Trading, DEMAT, and a bank account, all rolled into one.

This is to provide a seamless banking & investing experience for individuals so that they do not face hassle while connecting a bank account with their trading and Demat account

How to Buy IPO in Zerodha?

One can easily buy an IPO using Zerodha by Zerodha Console. Connect your UPI ID with Zerodha and place your IPO Bids. The IPO window is available from 10 AM to 5 PM on trading days.

What is Zerodha Sentinel?

Zerodha Sentinel is a tool to get real-time market alerts for all 90,000+ stocks, bonds, F&O contracts, and currencies across exchanges

Is Zerodha Sentinel Free?

Yes, Zerodha Setinel is Free. You first need to open a Zerodha Demat Account online and then access the Zerodha Sentinel for free

The stock market in India is closed every Saturday, and Sunday, and also on the BSE & NSE holidays.

Do keep in mind the share market timings, and plan your investments. Check out the best Stock Trading Apps in India and the Stock Market Websites to follow.

Happy Trading!

i m not working accont opening

What is issue Sir? Can you call 9838479931

Sir,

Please activate my new demate account with zerodha.

please call 9838479931