- Stock Broker Reviews

- Open Demat Account

-

- Broker Comparison

- Resources

- Trading Tools

- IPO

- Articles

- Investing Articles

- A Complete Guide: An Investment Plan With Your Partner

- An Investment Plan for those with >7LPA packages

- Complete Guide: Investing In Indian Markets

- Sebi Guidelines And Rules For Opening A Demat Account

- How And What To Research Before Investing

- Pro Investing Tips To Secure And Maintain A Large Pool Of Wealth

- 5 Reasons Why You Should Invest 20% of Your Income

- 10 Golden Rules Of Investing

- 10 Reasons why you should start investing in your 20s

- 10 Reasons You Should Begin Investing

- 10 Things NOT To Do While Building Financial Muscle in 2023

- 5 Habits Of A Successful Investor

- Demat Account

- Investing Articles

- Stock Broker Reviews

- Open Demat Account

-

- Broker Comparison

- Resources

- Trading Tools

- IPO

- Articles

- Investing Articles

- A Complete Guide: An Investment Plan With Your Partner

- An Investment Plan for those with >7LPA packages

- Complete Guide: Investing In Indian Markets

- Sebi Guidelines And Rules For Opening A Demat Account

- How And What To Research Before Investing

- Pro Investing Tips To Secure And Maintain A Large Pool Of Wealth

- 5 Reasons Why You Should Invest 20% of Your Income

- 10 Golden Rules Of Investing

- 10 Reasons why you should start investing in your 20s

- 10 Reasons You Should Begin Investing

- 10 Things NOT To Do While Building Financial Muscle in 2023

- 5 Habits Of A Successful Investor

- Demat Account

- Investing Articles

Open Angel One Account

Table of Contents

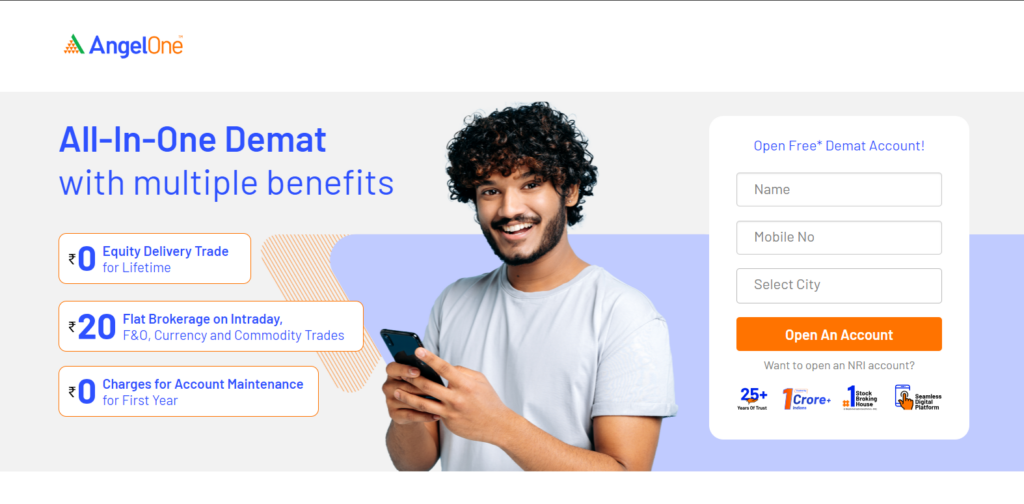

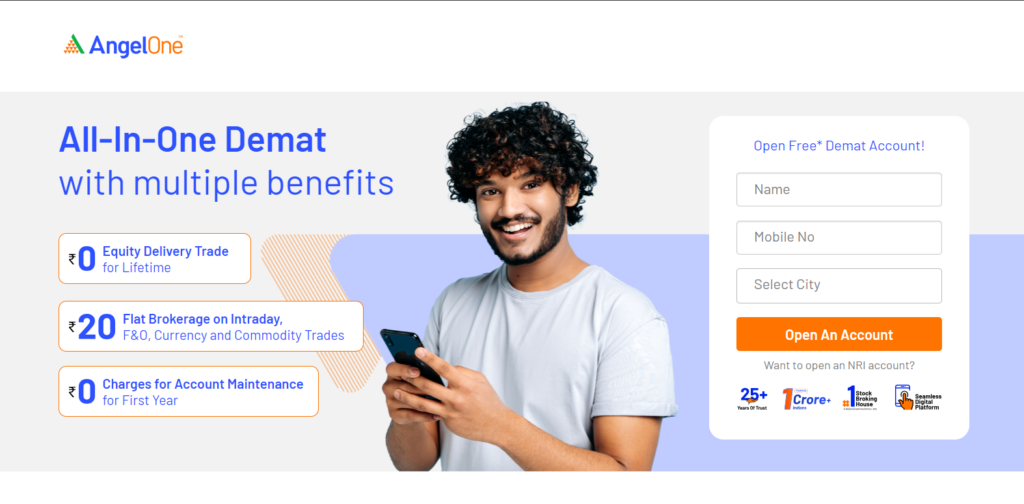

With more than two decades of providing Demat Account services, Angel One is one of the best discount brokers in India that offers a Free Demat Account Opening

Opening Angel One Account comes with multiple benefits like zero brokerage on Equity delivery, Mutual Funds, and much more.

An Angel One Account allows you to buy Stocks, Sell Stocks, Buy Mutual Funds, Invest in IPOs, and perform Intraday Trading.

In this blog post, we will look at the detailed process of Opening an Angel One Demat account Online, Digital Documents required

We will also know how soon you can Open Angel One Account

Why should you Open Angel One Account?

Pros:

One Platform for Entire Demat need

Free Account Maintenance Charges for 1 year

Flat Rs 20 On Intraday Trades

Easy-to-Use Console

Cons:

The Educational Content Should be Improved

Here are a few reasons to open an Angel One Online Account Opening.

- Zero Brokerage Charges on Stock Investments

- No Charge for Annual Maintenance for First Year

- A User-Friendly platform with no hidden charges

- Can Analyse US Stocks, F&O, Commodities

- Easy to use Console to Apply for IPO, Buy Mutual Funds, and Trade in Equity

- A Strong Customer Support

Charges to Open Angel One Account

Opening Angel One Account is totally Free.

You also get a rebate on First Year AMC if you open Angel One Account.

From 2nd Year onwards…

Non-BSDA Clients ₹ 20 + Tax / Month

For BSDA (Basic Services Demat Account) Clients: – Holding Value Less Than 50,000: NIL – Holding Value Between 50,000 To 2,00,000: ₹ 100 + Tax / Year

Thus, Demat Account Opening Charges with Angel One are totally free of cost

How Open Angel One Account Online Fast in less than 5 mins

Angel One Account Opening is an easy process where one can quickly open a demat account. All you need is a Pan Card, Aadhaar linked with your Mobile number and a laptp.

Checkout the detailed Step by Step process to Open a Deamt Account with Angel One online by following the steps shown below.

Step 1 – Register to Open Angel One Account

Register for Angel One Account Online by clicking here on this Direct Link

After adding your information to open Angel One Account Opening link and fill in basic information like your name, phone number and city name.

Enter Code : MAHUU for Free AMC for First Year!

You will receive an OTP on your mobile number which you have to enter to complete Angel One sign up.

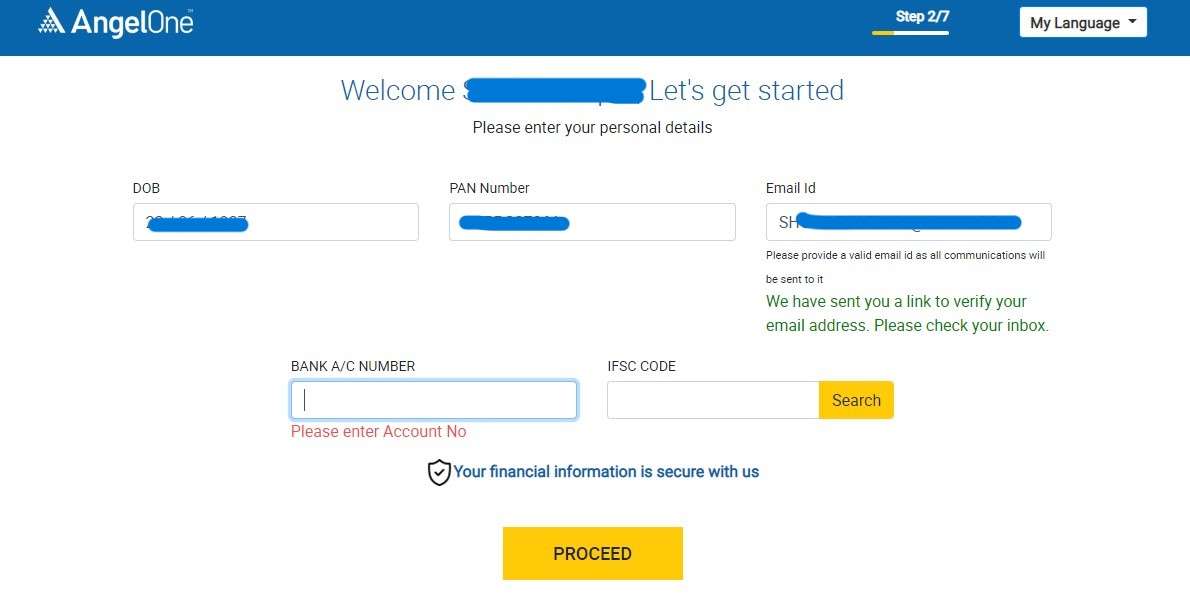

Step 2 – Enter Pan Card and Bank details along with Date of Birth

Enter your Date of Birth, pan number, Email Id, Bank account number & IFSC code as shown in the image below

Click on the Proceed

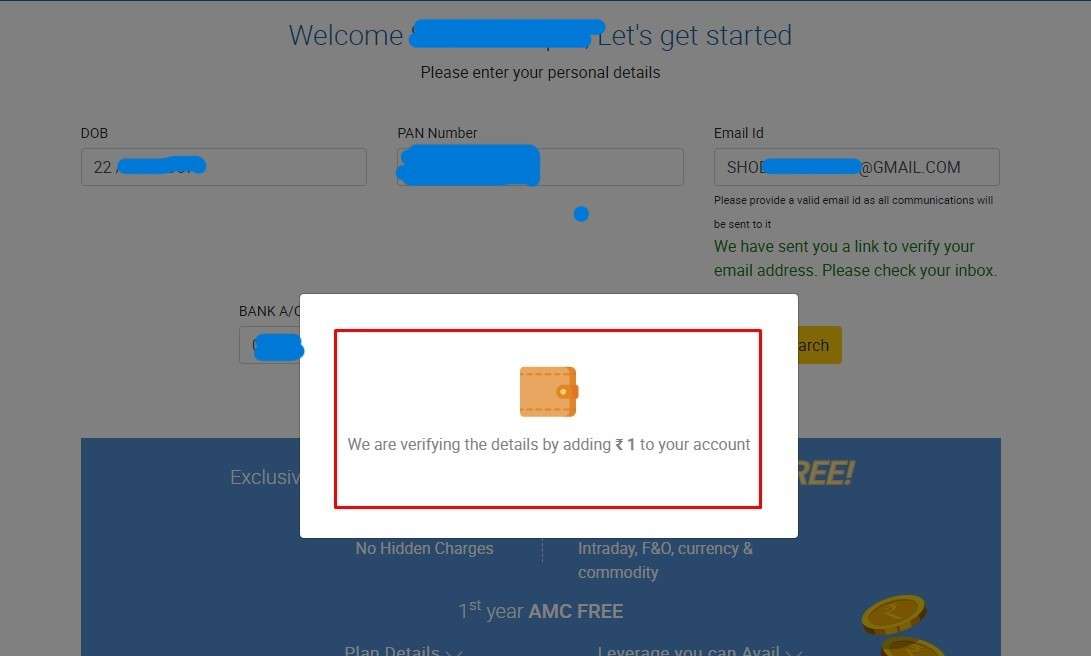

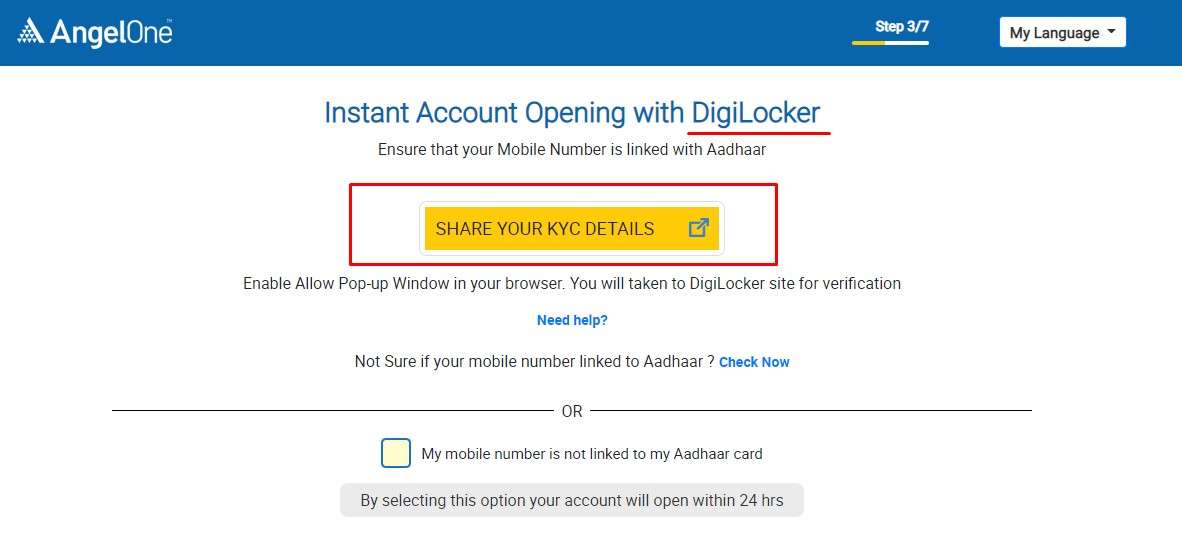

Step 3 – Get Your Verification Done to Open Angel One Account Online

After your email Address is Verified,

You wil have an option for verifying your KYC Details via Digilocker.

Angel One will deposit Rs 1 in your account

Step 4 – Verify with DigiLocker and Open Angel One Account instantly

The easiest and fastest way to Open Angel One Demat account is to verify your account via Digi Locker

You can share the KYC details and documents via DigiLocker by selecting “share via Digilocker” and clicking on proceed.

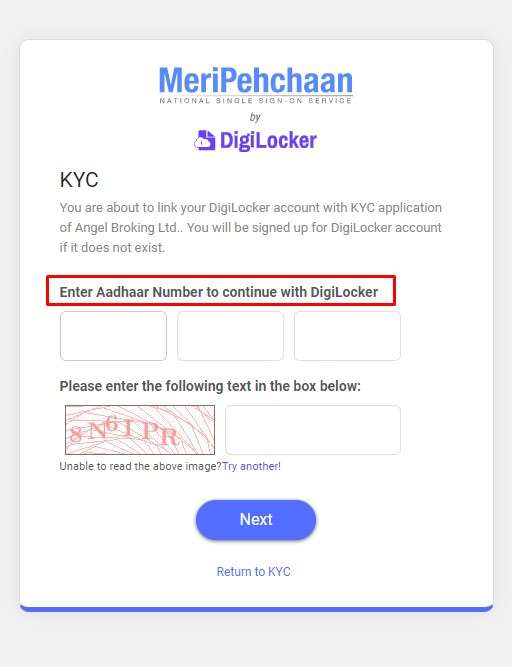

Step 5 – Enter Aadhaar Details and enter OTP

You need to enter your aadhar number and click on “sign in with OTP”

You will receive an OTP sent on your registered mobile number from UIDAI

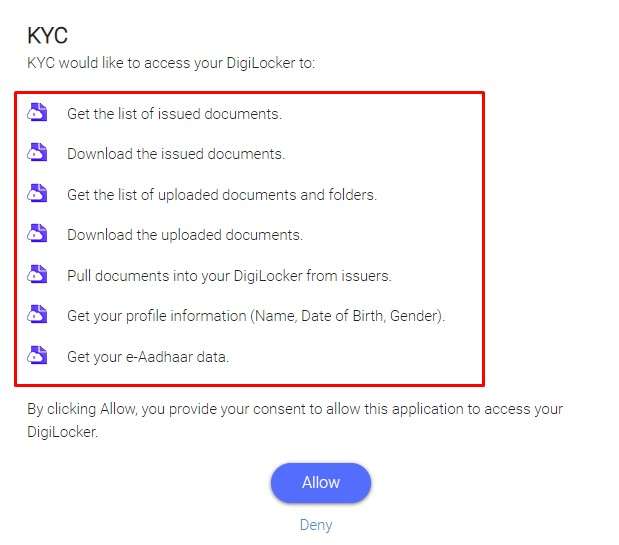

After you have given your consent to UIDAI to share the documents for Demat Account opening, you will have to upload your Pan Card and Signature

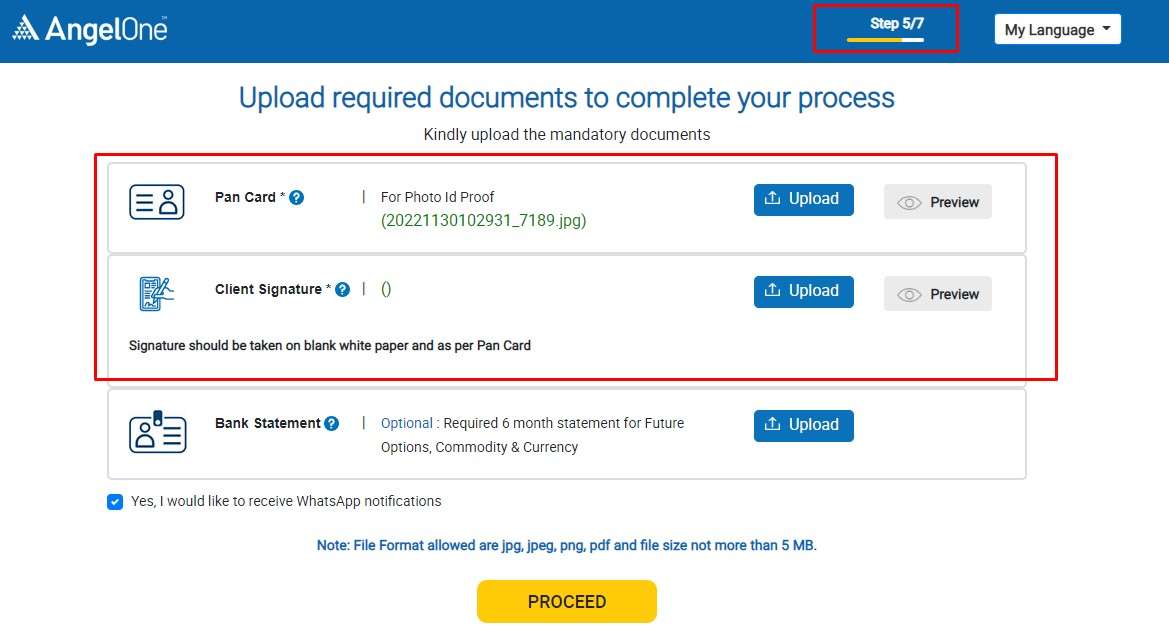

Step 6 – Upload Pan Card and Signature

After DigiLocker verification, you will upload two documents for Angel One Account Opening Online Process

- Scanned Copy of Pan Card

- Scanned Copy of Signature

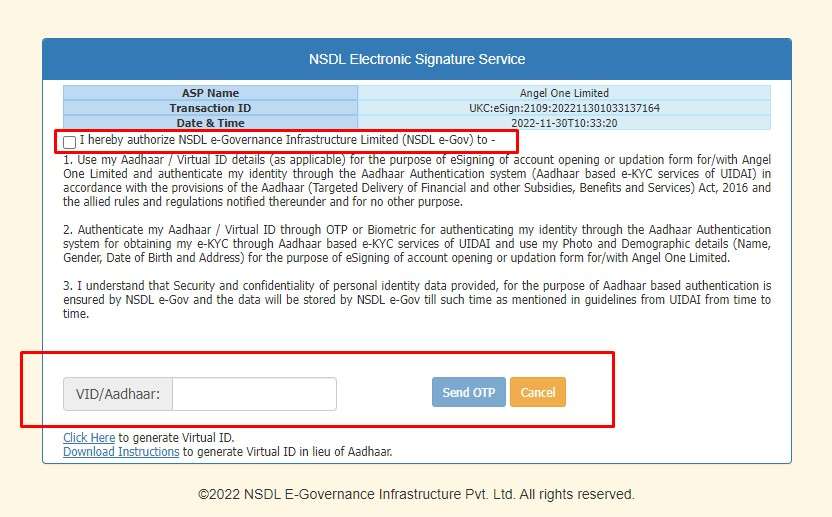

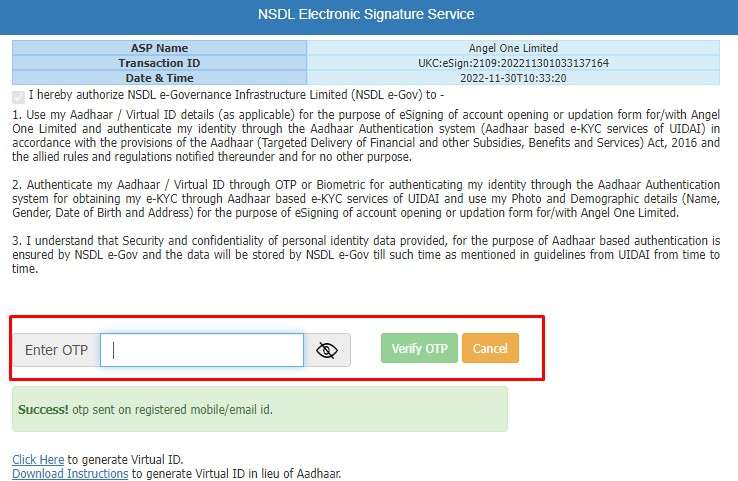

Step 7- Esign process by NDSL

When you click on the e-sign process, the NSDL website will pop out.

Enter your Aadhar number and enter the OTP received on your mobile number

E-sign your Angel One Account Opening form through Aadhar

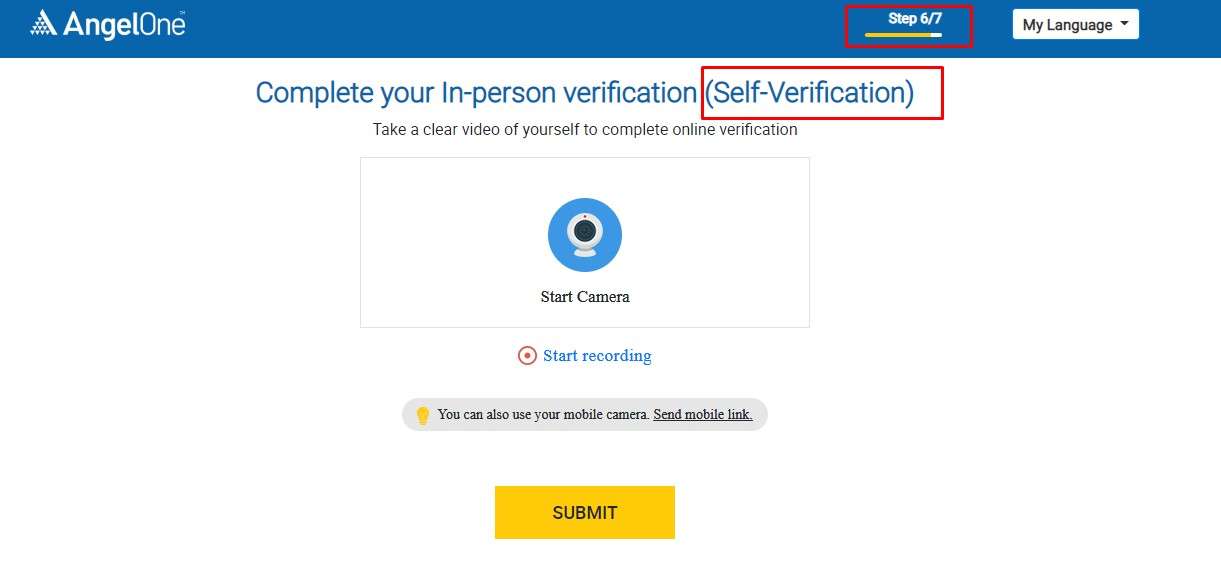

Step 8 – Complete your In Person Verification by Capturing an Image

Post the NDLS eSign, Angel One will ask for your Photo.

You can record a clear video of yourself from your Laptop Camera.

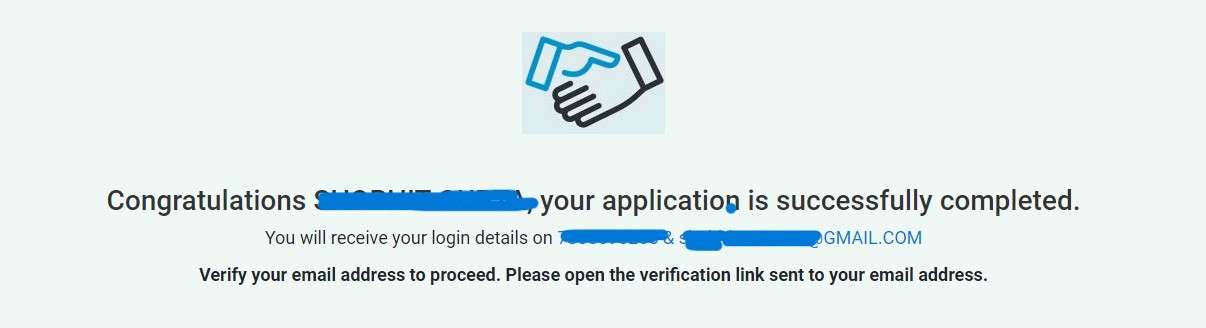

Step 9 – Login to your Email Account and Check for Login Credentials

Once the Photo is captured, you will get your Login Credentials on your email ID

You also should verify the verification link sent to your email Id

Step 10 – Post Account Verification, Add Money, and Start Your Investment Journey

Once your Account is verified, Angel One may take a day or two to allow you to start your investing journey

Angel One Account Brokerage Charges

Equity Investments come with zero brokerage charges.

Intraday Trading in Equity, Futures, and Options is charged at Rs 20/Executed trade or 0.25% whichever is lower

Currency Futures and Options are charged at Rs 20/Executed trade or 0.25% whichever is lower

Angel One brokerage charges are fixed irrespective of the trading volume.

| Brokerage | Charges |

|---|---|

| Equity Delivery Trading | Free |

| Equity Intraday Trading | Rs. 20 per executed order or 0.25% (whichever is lesser) |

| Commodity Options Trading | Rs. 20 per executed order or 0.25% (whichever is lesser) |

| Equity Futures Trading | Rs. 20 per executed order or 0.25% (whichever is lesser) |

| Equity Options Trading | Rs. 20 per executed order or 0.25% (whichever is lesser) |

| Currency Futures Trading | Rs. 20 per executed order or 0.25% (whichever is lesser) |

| Currency Options Trading | Rs. 20 per executed order or 0.25% (whichever is lesser) |

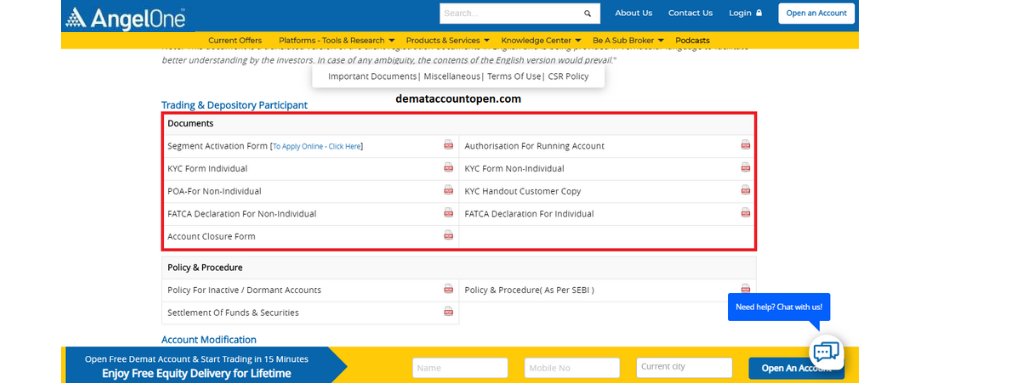

Angel One Demat Account Opening – Offline Process

If your aadhar card is not linked with your mobile number, you need to do an IPV (in-person verification) by holding a PAN card and aadhar and recording a video.

You need to take a print out of offline forms, make signatures on them and courier to the Angel One head office address. It will take 7 days to process your forms and complete the Angel One Account Opening process.

Documents to Open an Angel One Account Offline

To open an Angel One Demat Account, you need to courier forms along with the documents.

The documents required for the Angel One Account Opening are

- Pan Card

- Aadhar Crad

- 6 Month Bank Statement

FAQs to Open Angel One Account Online

Does Angel One Charge for account opening?

Angel One Account Opening is totally Free. You can easily open an Angel One Demat Account online in under 5 minutes

What are Brokerage charges in Angel One?

For Equity Investments, the Angel One brokerage charge is zero.

For Equity and Commodity trading, Angel one brokerage charges is Rs. 20 per executed trade.

How can I open an Angel One Account?

You can easily open an Angel One Demat account online.

Click here to directly Open an Angel One Demat Account.

How can I close my Demat account in Angel One?

In angel One, both Demat and Trading Accounts can be closed online.

Can I open 2 Demat accounts in Angel One?

You can open multiple Demat accounts but with different brokers and depositories

Thus, you can only have one Demat account with Angel One because your Demat account is mapped with Aadhaar

If you are looking to open more Demat Account, open one with Angel One ( Depository = NDLS) and Open another Demat account with Zerodha ( Deposiry = CDSL)

How much time Angel One take to open account?

Angel One Account Opening online can be done in less than 5 minutes.

Post you have verified your account, Angel One takes upto 24 Hrs to allow you add money in your account and start investing

Is angel One Demat account free?

Yes, Angel One Demat account is absolutely Free and comes with a Free First Year AMC fees

Search any Post

New on Blog!

- A Complete Guide: An Investment Plan With Your Partner

- An Investment Plan for those with >7LPA packages

- Complete Guide: Investing In Indian Markets

- Sebi Guidelines And Rules For Opening A Demat Account

- How And What To Research Before Investing

- Pro Investing Tips To Secure And Maintain A Large Pool Of Wealth

- Demat: Basics, Types, and Benefits

- 5 Reasons Why You Should Invest 20% of Your Income

- 10 Golden Rules Of Investing

- 10 Reasons why you should start investing in your 20s

- What Is A Demat Account?

- 5 questions To Ask Yourself Before Opening A Demat Account

- 10 Reasons You Should Begin Investing

- 10 Things NOT To Do While Building Financial Muscle in 2023

- 5 Habits Of A Successful Investor