Upstox is one of the best discount brokers in India with over 5+ lakh clients. It offers trading services in equity, currency and commodity options. Upstox customers can buy stocks, mutual funds, IPO and trade in derivatives at BSE, NSE and MCX.

Most of the people who opened a Upstox Demat Account don’t know how to use its trading platforms for buying and selling stocks.

So in this article, we provide you with detailed information on how to buy/sell shares in Upstox Pro Application.

If you don’t have a demat account then it is highly suggested to Open Upstox Account Using this direct link to access their trading platforms and offers for free.

Related Post: How to use Upstox Margin Calculator & Upstox Brokerage Calculator

How to buy shares in intraday through the Upstox Pro App?

Table of Contents

In Intraday trading, you need to buy and sell the stocks on the same day. To buy and sell stocks using Upstox Pro App, you need to know about a few important steps, which are

Monitoring the stocks

- To analyze a stock, you need to select the stock you wish to buy from your watchlist.

- After selecting the stock, you can check its details like market depth, bid, the number of orders, offers, and quantity along with the “buy” and “sell” option will appear.

- Before you place the “buy” or “sell” order, you can view and examine the charts of that particular stock by clicking on the “charts” icon.

Placing the Buy order in Upstox Pro App

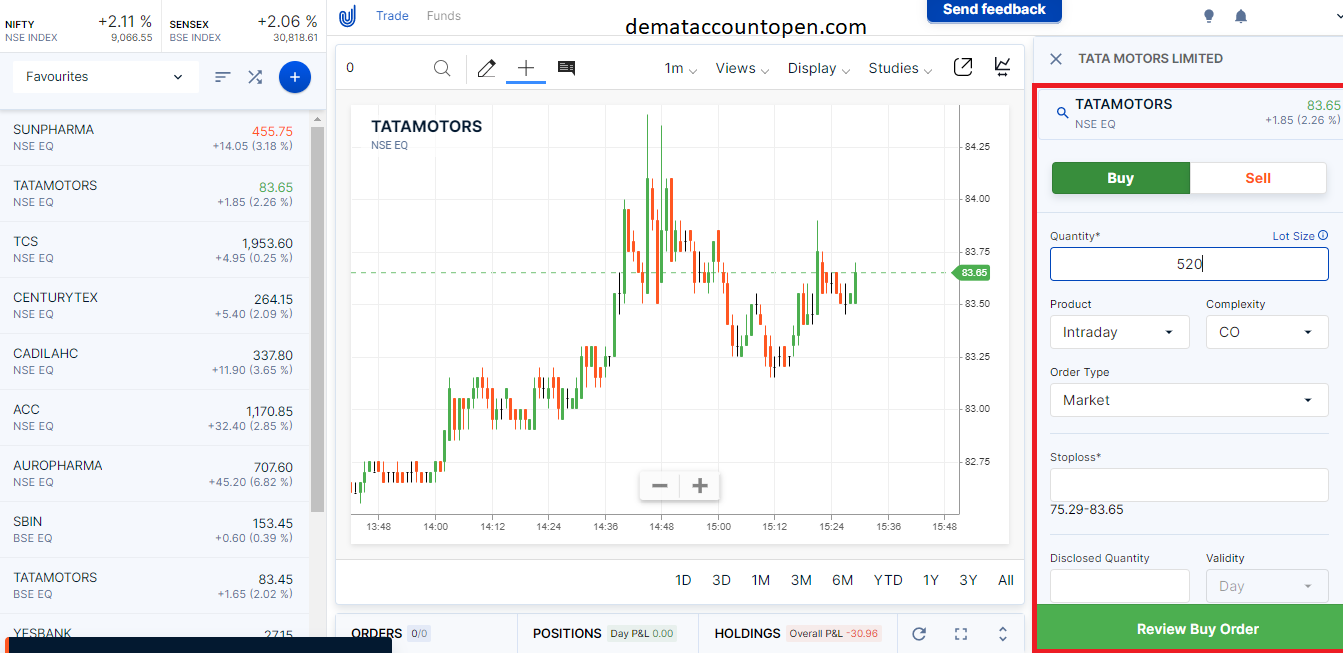

Once you have selected the stock in which you want to trade, you need to click on “buy” which is marked in blue colour and fill the quantity of stock you would like to purchase.

After entering the quantity, you need to select the “Intraday” box which is in Product. Since we are carrying out an intraday trade, we need to square off the buy position and sell position before the market closes.

Select the order type in Upstox Pro App

To place the stop-loss order using Upstox Pro, you need to follow the steps below.

- The options provided by Upstox Pro App to select the order type are

- Market

- limit order

- SL limit(stop loss limit order)

- SL Mkt (stop loss market order)

- If you are looking to place a market order, then you need to select the “market” as your order type. In the market order, you will not be able to change the order price because it will be executed on the current market rate.

- If you are looking to place “limit” as the order type, you have a profit to set an order type as per your desire. In this, the “buy” order will be executed if the limit price is reached before the auto square off time. If you have selected a Limit Price at Sell Order entry then you have to give above the market price.

- SL stands for Stop Loss buy order. Stop-loss buy order means that a limit buy order is placed when the stock hits a certain trigger price. SL order is useful when you want to buy the share when your stock goes above a certain price. An example is some stock is trading at Rs 150 and you want to buy that stock only if it goes above Rs 152, you place an SL order with 152 as trigger price and any price below 152 as the limit price. The limit orders are places when the stock hits the stop-loss trigger price. Note: There is no guarantee that your order will get executed in this case. In cases when stock spikes up very fast and does not come back, your limit order will remain open.

- SL-M stands for Stop Loss buy order at Market price. It is same as previous SL order with one small difference – when stopping loss trigger price is hit, then market order will be placed instead of a limit order.SL -M order is useful when you want to buy the share when your stock goes above a certain price. An example is some stock is trading at 100rs and you want to buy that stock only if it goes above Rs 152, you place an SL-M order with 152 as trigger price (there is no limit field here as market order). The market orders are placed when the stock hits the stop-loss trigger price. Note: Since its market order, it’s likely it will get executed slightly above the trigger price depending on the order quantity and seller availability. In cases when stock spikes up very fast, executed price may be some points above the trigger price

Placing advanced orders

You can place advanced orders under this segment, you can place advanced orders by place orders with

- Simple Order

- OCO which is Bracket Order,

- CO which is Cover Order, and

- AMO which is Aftermarket Order.

Related Post: Know how to login Upstox Trading Platform

Buying & Selling Stocks using Upstox Pro Simple order

If you are looking to buy or sell stocks using simple order, then you don’t need to place any stop-loss or target price.

Buying & Selling Stocks using Upstox Pro Bracket Order

You can trade in range by selecting “Bracket Order”. You need to set a “target price”, the position will square off only when the stock hits the target price.

You can enter a “stop-loss price” which will help you to reduce your losses. The whole set up of bracket order works as a bracket for your order that assures profits or losses as per the market movements.

Buying & Selling Stocks using Upstox Pro Cover Order

If you are looking to buy the shares using Cover Order it is advised to put a “stop-loss trigger” as the order provides a higher leverage/margin.

The difference between the current price and the stop-loss placed should not be more than 2% of the risk-reward ratio. You can cover your losses by placing an order using Cover Order.

Buying & Selling Stocks using After Market Order

After Market Order is a particular order for those investors who are not available to trade during the Stock Market Timings. You can place After Market Orders in Upstox Pro between 3:45 pm to 9:00 am.

To place an order, you can select the stock you wish to purchase, fill in the quantity and price you want to purchase and select “AMO” from the “Complexity” section.

The validity of the order

- The validity of the order contains two options, which are “DAY” and “IOC – Immediate or Canceled”.

- If you select the day validity, your order will remain valid for that entire trading day.

- You can select an Immediate or Canceled (IOC) validity if your order quantity is huge.

- Let us take an example if you have placed 90 orders and get a seller for only 50 of them. As IOC in upstox is applied the 50 orders will be executed while the remaining 40 will be cancelled.

You can place orders by using both Upstox Pro Web or Upstox Pro mobile applications. As the desktop has a bigger display, you can easily monitor the charting. You can also avail the margin from the stockbroker to execute a trade.

How to buy Delivery shares in Upstox Pro App?

Delivery trades are done when an investor does not wish to sell the share on the same day. To buy the shares in delivery, you need to enter the quantity of stock you wish to buy and click on “Delivery” under the “product” section.

As Delivery stocks are designed for long-term investments, it is better to select “market” as the order type because nothing can be predicted exactly for a longer span of time.

Open Demat Account

Broker | Rating | Link to Open | |

|---|---|---|---|

Zerodha No.1 Stock Broker in India | ★★★★★ | ||

Upstox | ★★★★ | ||

Angel Broking | ★★★★ | ||

5 Paisa | ★★★★ | ||

StoxKart | ★★★★ |

Leave a Reply