Golden Rules of Intraday Trading

Table of Contents

Every trader’s aim is to make more profits in the stock market. It is very important to know that day trading is one of the best options that allow buying and selling the stock on the same day. Here are some lists of golden rules for intraday trading to make huge profits.

Trade in the direction of the trend

Every trader needs to know how to identify trends. Because intraday markets are like a sea wave, moving up and down regularly. An intraday trader needs to go with the current market trends.

What is the trend?

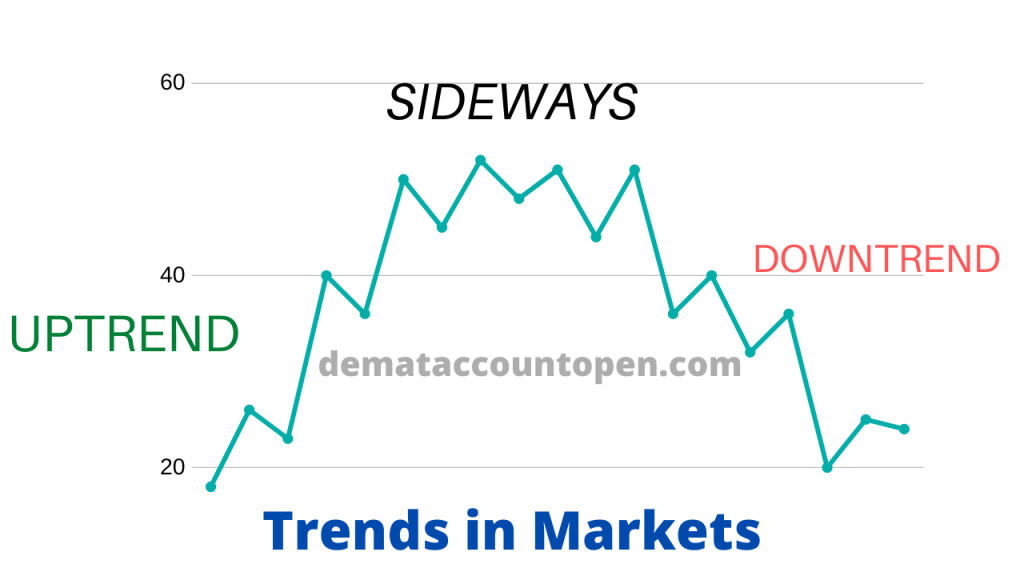

A trend tells the direction of the stock that is moving, based on the bullish or bearish market. They can be moved either upwards or downwards. There is a specific time to recognize a trend. However, the longer it moves the unique trend it becomes.

What is Uptrend?

An uptrend specifies the market is moving up. At that time, investors are very positive. A trend line is formed by considering higher highs or higher lows to confirm the current price direction. Trendlines are represented as support and resistance in any time frame. Here uptrend act as a support and tell that more orders can take place even if the price increases. When the share price continuously increasing, then we can consider it as a solid and a break below the uptrend line shows that demand has reduced and a change in trend could be expected.

What is Down Trend?

When the trend line is moving downwards for a long time, then it is known as downtrend, and it is created by joining lower lows and lower highs. Downtrend lines act as resistance and show that net-supply is rising even as the share price drops. As long as share prices continuously move in a downtrend, we can consider it as stable. A break above the downtrend line shows that supply is reducing and that a change of trend could be expected.

What is Sideway trend

A sideways trend is the horizontal price movement that happens when the demand and supply is almost equal. A break above the downtrend line shows that supply is decreasing and that a change of trend could be ex[ected. Shares that vary within a price range for a few days, weeks, months, etc. are recognized to be in a sideways trend. A sideways trend is also known as a horizontal trend.

How to identify trends using moving average

Moving average is used to determine the trend. The easiest approach is to plot a moving average on the chart. When the share price is above the moving average, it indicates that the price is in UPTREND. If the share price is below the moving average, then it shows that it is a DOWNTREND.

Stock has 3 trends uptrend, downtrend and sideway trend and buy stocks when they are in uptrend and sell stock when theory are in downtrend. Uptrend can be found by higher highs and higher lows and down trend can be found by lower highs and lower lows.

Always put Stop Loss in Intraday Trading

What is Stop Loss?

Stop Loss can be defined as the level where you have to book your losses if your trade goes wrong .Lets say you bought a stock at 100rs in Intraday trading assuming it will go up. Instead it starts to go down and you start making loss. If you don’t have a cut level for your losses, you can lose big money in single day. The aim is to restrict the loss on a trade. It can be helpful for both short term trading and long term trading. Stop-losss is also called a stop order.

Example:

You purchased a share at 50 rupees and then put a stop loss at 45 rupees so if the share price reaches 45 you booked your loss.

Why Stop loss is Important

Every trader will trade in the stock market with limited capital. So the primary goal of trading is to protect your money. This can be possible by using a stop loss.

Stop Loss can help to save from significant loss because of market volatility. The only way is to defend your downside risk by setting proper stop-losses while trading.

Use Discount Broker to save brokerages

If you are going to do intraday trading , you will have to do many buy sell transactions throughout the day. Stock brokers charge brokerage on all transactions . Therefore , its advised to chose lowest brokerage and best platforms for cost effective and good trading experience. You can save up to 90% of brokerage if you switch from traditional full service broker to discount broker like Zerodha or Upstox.

Broker | Rating | Link to Open | |

|---|---|---|---|

Zerodha No.1 Stock Broker in India | ★★★★★ | ||

Upstox | ★★★★ | ||

Angel Broking | ★★★★ | ||

5 Paisa | ★★★★ | ||

StoxKart | ★★★★ |

You can call us on numbers given on top of this website for free demat account with best discount brokers

Only Trade with the excess money

One of the most important intraday trading habits is not to be careless. New traders who have good returns in intraday trading think that it is the best way to earn more profits and they start investing more money and finally end up with a major loss.

Intraday trading is a risky option in the share market. There is a chance of losing all your money within no time if you are with the wrong trade. Intraday trading is very risky, and traders can start investing with the excess money that they can afford to lose.

Example: If the company share fell more than 70% from 500 rupees to Rs 150 rupees in one day. A sudden movement in the market can lead to more loss than investing in the stock market. Its very Important intraday rules.

Never do over trading

Never hold too many trades in Day trading because it leads to major losses. It is always advisable to carry 1 or 2 trades instead of holding 5 to 10, which can provide you with enough capital for intraday. Nobody can be a billionaire in a day so never do over trading on intraday. It is better to use the position size calculator to hold the right quantity of shares for your investment.

Many intraday traders do over-trading. We recommend if you have an Rs. 50,000 put a trade of 30000 to 35000 rupees never put all your money in one trade or more trades, If you are very sure of reaching your targets. Sudden news can reverse the stock trends and can face the major loss. Never do overtrade to overcome your losses. It is one of the most important rules in intraday trading.

Trade only in stocks having a high volume

Volume in stock shows how many shares have traded in the stock exchange. It is a very crucial data, and we can notice a lot of details from it. You can use the intraday screener to find high volume stocks.

The volume of a few firms is always high, and the volume of a few firms is always low. For example, 30 thousand shares of reliance are traded every day. Some penny stocks firms can have daily trade volume on hundreds.

Low Volume: Low volume tells there are fewer number of shares traded in the stock exchange. We should always avoid those shares due to liquidity. So only a few people want to trade in it.

High Volume: High volume tells there are a high number of shares traded in the stock exchange. We should always prefer these shares due to high liquidity.

How to open Demat account and trading account?

Keep up the good work.