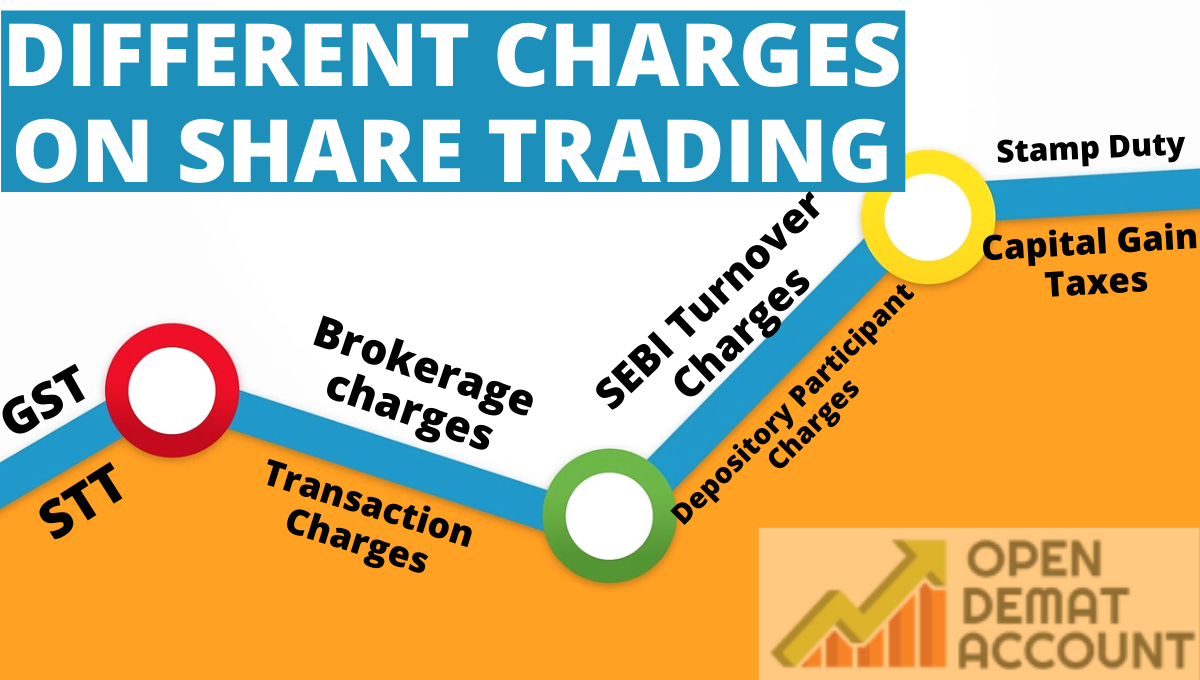

There are a number of charges and taxes included while trading in Indian stock market. Some of them are very popular like Brokerage Charge & GST, whereas there are many other charges that most of the traders are not aware of.

In this post, we are going to describe different charges on share trading. Some common ones are brokerage charges, Security transaction tax, Goods & service tax, stamps duty, transaction charges, SEBI turnover charges, depository participant (DP) charges, and capital gain tax.

Different Charges on Share Trading

Brokerage charges

There are two types of stockbrokers in India, one is a full-service broker and the other one is a discount broker. A full-service broker charges a brokerage between 0.03% to 0.60% of the transaction volume while trading in stocks. On intraday, the discount brokers charge a flat fee fixed rate of Rs 10 or Rs 20 per trade.

Most of the discount brokers like Zerodha & Upstox do not charge any fee on delivery trading. It is important to note that you have to pay a brokerage charge on both buying a share and selling a share.

In spite of brokerage charges, there are also additional charges and taxes that you should pay while trading in the Indian share market. Let’s know about the different charges and taxes included on share trading.

You can click here to know how to use Zerodha Brokerage Calculator

STT Charges

STT full form is securities transaction tax. STT is the next biggest charge involved while trading in stocks apart from the brokerage charge. For delivery trading, securities transaction tax is charged on both buy-sell which is equal to 0.1% of the total transaction price.

For intraday and FNO, securities transaction tax is charge is 0.025% of the total transaction price only when you sell the stock. For equity Futures, the STT is equal to 0.01% on the sell-side and for equity options trading, the STT is equal to 0.05% on sell-side.

Transaction Charges

The transaction charges are charged by the stock exchanges and that too on both buying and selling of a stock. For both intraday & delivery trading the charges will be the same.

National stock exchange (NSE) charges a fee of 0.00325% of the total turnover as Transaction charges on Equity and Delivery Trading whereas the Bombay stock exchange (BSE) charges a fee of 0.003% of total turnover.

For Derivatives trading, BSE doesn’t charge any transaction charges. But NSE charges the Exchange transaction charge of 0.0019% for futures trading and 0.05% of total turnover for Options Trading.

Goods & Service Taxes (GST)

GST is the compulsory tax levied by the government on the services provided and is equal to 18% of total brokerage and transaction charges.

SEBI Turnover Charges

The full form of SEBI is Securities Exchange Board of India and it is the stock market regulator. SEBI makes the laws and regulations on the exchanges for its conventional functioning.

SEBI Turnover fee is charged on both buying and selling and is the same for all types of trades you make. The SEBI turnover charge is equivalent to Rs 10 per crore of the total turnover.

Depository Participant Charges

There are two stock depositories in India which are NSDL (National Securities Depository Limited) and CDSL (Central Depository Services Limited). Whenever you buy a share, it is stored in an electronic form in a depository. To provide this service, the depositories costs some fixed amount.

The depositories don’t charge the traders or investors list but charge the depository participant. The brokerage firm or your demat account company which you are using for trading is the depository participant.

Depository Participant works as a linkage between the depository and the investor as the investors cannot directly approach the depository.

Stamp Duty

Stamp duty is charged regularly irrespective of the state of residence effective from July 1st, 2020. These new rates are only on the buy-side. The new rates on stamp duty on different types of trades are as below

- For Delivery trading, it is 0.015% or Rs 1500 per crore

- For Intraday trading, it is 0.003% or Rs 300 per crore

- For Futures (equity and commodity), it is 0.002% or Rs 200 per crore

- For Options (equity and commodity), it is 0.003% or Rs 300 per crore

- For Currency, it is 0.0001% or Rs 10 per crore

- For Mutual funds, it is 0.005% or Rs 500 per crore

- For Bonds, it is 0.0001% or Rs 10 per crore

Capital Gain Taxes

There are two types of Capital gain taxes if you trade in the Indian stock market which are Short-term capital gain tax and Long-term capital gain tax.

If you sell a stock within one year of buying it, then this trade is recognised as a Short-term capital gain tax. In short-term capital gain tax, a flat 15% of the profit is charged.

If you sell a stock after holding it for one year, then it is recognised as the long-term. For the long term capital gain. In long term capital gain tax, you have to pay a tax equivalent to 10% of the gains, if it exceeds Rs 1 lakh.

If you trade in intraday, you need to pay taxes on their capital gains which depends on their tax-cutting. Let us take an example, if you’re in the highest tax-cutting and made some profits while intraday trading, you’ve to pay taxes of 30% on those gains.

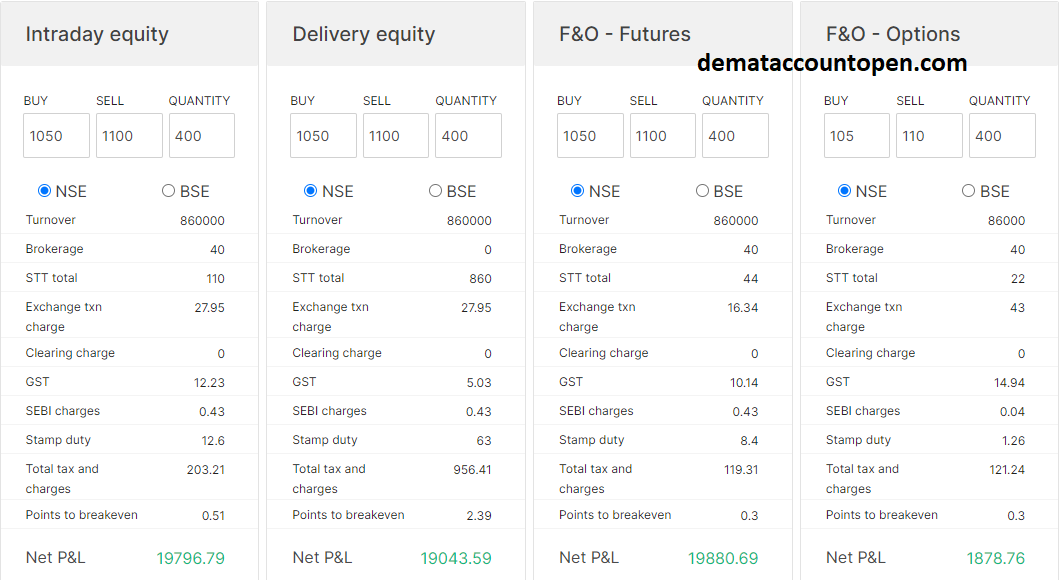

Charges Breakout

Let us take an example, If you buy 400 shares at Rs 1050 and sell it at Rs 1050 then all charges are shown in the image below.

FAQs

Open Demat Account

Broker | Rating | Link to Open | |

|---|---|---|---|

Zerodha No.1 Stock Broker in India | ★★★★★ | ||

Upstox | ★★★★ | ||

Angel Broking | ★★★★ | ||

5 Paisa | ★★★★ | ||

StoxKart | ★★★★ |

Leave a Reply